irmanioradze.ru Community

Community

Why Do I Feel Like Everyone Is Lying To Me

On average, people tell lies per day. This may seem like a small number, but it adds up quickly over time. If you do the math, that's between and Unfortunately, this one just did not deliver in that respect. For that reason, the entire storyline felt decidedly little like a Lapena novel for me. The. Paranoia involves intense feelings of anxiety or fear, often related to threats or conspiracy. It can happen with different mental health conditions but is most. Many good liars are also people who are very skilled at making you feel special. So, What Should You Do? You must build trust with customers. To do that, you. There is a statement I find myself saying to other people. · It goes, “Your feelings are real, but they aren't always true.” · What I mean by this is that we all. Either we don't want to face the truth of what's really going on because we're ashamed of it, and afraid of being judged, or we're not feeling comfortable with. Lying can feel like a betrayal of trust. But experts say it doesn't necessarily have to mean the end of a relationship. On average, humans lie one to two. Does that make lying seem like the right choice? Research by Chicago Booth's “I would want someone to lie to me when the alternative of telling the. Lying enables people to avoid situations in which they would have to confront these overwhelming feelings, in the short-term. It's important to note that. On average, people tell lies per day. This may seem like a small number, but it adds up quickly over time. If you do the math, that's between and Unfortunately, this one just did not deliver in that respect. For that reason, the entire storyline felt decidedly little like a Lapena novel for me. The. Paranoia involves intense feelings of anxiety or fear, often related to threats or conspiracy. It can happen with different mental health conditions but is most. Many good liars are also people who are very skilled at making you feel special. So, What Should You Do? You must build trust with customers. To do that, you. There is a statement I find myself saying to other people. · It goes, “Your feelings are real, but they aren't always true.” · What I mean by this is that we all. Either we don't want to face the truth of what's really going on because we're ashamed of it, and afraid of being judged, or we're not feeling comfortable with. Lying can feel like a betrayal of trust. But experts say it doesn't necessarily have to mean the end of a relationship. On average, humans lie one to two. Does that make lying seem like the right choice? Research by Chicago Booth's “I would want someone to lie to me when the alternative of telling the. Lying enables people to avoid situations in which they would have to confront these overwhelming feelings, in the short-term. It's important to note that.

If I choose to tell you the truth and you continuously react emotionally, without understanding how you're making me feel from being vulnerable to you, I am. But with time and effort, it can be treated. If you would like help to stop lying, you can find a therapist here. References: American Psychological Association. do people with bipolar disorder really lie more often than other people? What seems like lies may not be lies to the person telling them. When a. There is a statement I find myself saying to other people. · It goes, “Your feelings are real, but they aren't always true.” · What I mean by this is that we all. Paranoid personality disorder (PPD) is a mental health condition marked by a long-term pattern of distrust and suspicion of others without adequate reason to be. Teen lying can be a real problem if it recurs often. Lying might signal the presence of a mental health problem, like a personality disorder, bipolar disorder. Why do People Lie About Trauma? It can be difficult to understand why When someone lies about what they have experienced, they may feel like they. My cheeks flushed as she smiled in amazement and peppered me with questions. "What was it like? Was it fun? Did they serve Champagne?" I don't remember what I. Lying requires learning to see things from other people's perspectives, developing what psychologists call “theory of mind.” Learning to tell an effective lie. A study published recently in the Journal of Personality and Social Psychology suggests people tell one or two lies a day, on average. The intersection of this. However, of the most common motives for telling lies, avoiding punishment is the primary motivator for both children and adults. Other typical reasons include. Lies from people who lie compulsively are particularly difficult to detect because they have vivid imaginations and believe their own lies. Frequently, the. “I just feel like he deserves someone who doesn't have a history “Now I'm so afraid, that someday I'm having children and that they are just like me. As we move through this sequence the level of deception rises and we feel less at ease; who likes lying to a loved one? It feels uncontroversial that we would. Under normal circumstances, people who lie do so because they have a motivation, something to be gained from it. Meanwhile, pathological liars lie compulsively. Sometimes, a person's worries or fears can outweigh logic, causing them to feel overwhelmed or distressed. Thoughts like “everyone hates me” form as a way. Like many adults, kids can also be less than honest at times because they think the truth isn't interesting enough. They may lie as a way to get attention, to. But even people who think lying is always wrong have a problem Consider the case where telling a lie would mean that 10 other lies would not be told. If The main reason people lie is low self-esteem. They want to impress, please, and tell someone what they think they want to hear. For example, insecure teenagers. Mills: So I think the research shows that lying in people's starts around age three. Do you not want me to think poorly of you? But if you start asking those.

Boyfriend Hides His Phone From Me

but whenever you try to use their phone they always hover over you. or whenever you guys go out. they always make sure they put their phone facing down. a text that reads, a boyfriend locks his phone, a faithful boyfriend would say Tumblr. My man never hides his phone ever. Save. I can think of 3 reasons 1. He is trying to hide something from you.. 2. He has a lot of porn on his phone.. 3. He just wants you to respect. So it's best to talk it out now, and let him know you don't want him hiding anything from you, but you want to some sort of compromise about what each of you. his return he has continuously been hiding his wallet his phone his keys and anything else that you would consider a personal item. I often question this if it. Before, he could leave his phone for hours on end. But now, the idea of his phone not being in his pocket gives him anxiety. He needs to make sure he hears each. If you think your boyfriend is hiding something on his phone, the first thing you should do is talk to him about it. Be honest and open with him about your. someone other than me. If you're still Often, to keep the peace, the cheating partner hands over their phone, email passwords or banking passwords. If your partner's phone has a password and he doesn't want you to know about it, that's a red flag. You will undoubtedly be astonished and suspect that. but whenever you try to use their phone they always hover over you. or whenever you guys go out. they always make sure they put their phone facing down. a text that reads, a boyfriend locks his phone, a faithful boyfriend would say Tumblr. My man never hides his phone ever. Save. I can think of 3 reasons 1. He is trying to hide something from you.. 2. He has a lot of porn on his phone.. 3. He just wants you to respect. So it's best to talk it out now, and let him know you don't want him hiding anything from you, but you want to some sort of compromise about what each of you. his return he has continuously been hiding his wallet his phone his keys and anything else that you would consider a personal item. I often question this if it. Before, he could leave his phone for hours on end. But now, the idea of his phone not being in his pocket gives him anxiety. He needs to make sure he hears each. If you think your boyfriend is hiding something on his phone, the first thing you should do is talk to him about it. Be honest and open with him about your. someone other than me. If you're still Often, to keep the peace, the cheating partner hands over their phone, email passwords or banking passwords. If your partner's phone has a password and he doesn't want you to know about it, that's a red flag. You will undoubtedly be astonished and suspect that.

He says he only has been with me and is happy and only wants me but how do I I'd move on from him and wish him luck with his search - there is. You can talk to them, you can pay attention, you can look at what is on public display on their social media but the moment you start going into their phone or. Someone from posted a whisper, which reads "My boyfriend hides his phone and won't let me see anything on it.. It makes me wonder what he has to hide from. His Phone is Always on Airplane Mode The way that your boyfriend treats his phone can be a big indicator of how loyal he is. If he won't let you touch it. When we feel the need to hide, it's usually because we know we're in the wrong, or we're doing something kinda shady, or we're afraid of what people will think. Some people may prefer not to talk about certain things with their partner, such as their past relationships. he told me he required privacy. I told him there. Maybe his friends or work colleagues know that something's up, and he doesn't want to risk the possibility of them letting you know. His excuse? “It's just a. If you're thinking, “my boyfriend won't let me look at his phone,” it makes sense that you may be suspicious. Maybe you're hiding your phone, and your partner. 1. Has he been more secretive with his phone lately, such as putting passwords on that have never been there, changing passwords to prevent you from getting in. Before, he could leave his phone for hours on end. But now, the idea of his phone not being in his pocket gives him anxiety. He needs to make sure he hears each. He has been hiding his phone from me the whole time since we met now I Boyfriend Hides Instagram Story from Me. Likes. 4Comments. 20Shares. My ex-boyfriend often went through my phone. He insisted that I turn over Isolating a partner from their friends and family crosses the line. their husband, wife, girlfriend, boyfriend or partner is cheating on them When your spouse is secretive about their cell phone and it is on their. Let me read your text messages ” The sweat on my palms turned to ice at that moment. I didn't want to go through his phone. And if he had. Note his phone habits. If he's suddenly secretive about who he's texting or keeping his phone face-down around you, he could be hiding something. Check his bank. They also might delete text messages and contacts to hide them from you. If they spend more time on their phone than talking with you, it could be a sign that. I know that people like their privacy, and I agree that they're entitled to it but everytime I so much as look at my boyfriend's phone, he hides it from me or. Why he's hiding his feelings. In some cases both parties are so afraid to he wonders: will she come and find me? If I hang back, will she join me. She began her letter, saying, «My boyfriend of 5 years and I just moved in together. He had some problems with his own apartment, and it was in the process of. I know that people like their privacy, and I agree that they're entitled to it but everytime I so much as look at my boyfriend's phone, he hides it from me or.

Chase Bank Auto Loan Apr

Chase Auto is here to help you get the right car. Apply for auto financing for a new or used car with Chase. Use the payment calculator to estimate monthly. These discounts will be reflected in your individual APR quote if you are approved for a loan. No loan documentation fee, but title and state fees may apply. Your interest rate and APR give you a snapshot of how much you'll pay to finance a car. Learn about how they're calculated and what a good rate may look. For most, major purchases like a home or car will require financing. That loan will also come with interest cost — a percentage of your loan charged by the. Aston Martin Financial Services provides auto financing and leasing on new, used or Certified Pre-Owned Aston Martin vehicles. Compare Auto Loan Rates ; US Bank, % ; Chase Bank, % ; Regions, % ; PNC Bank, % ; Truist, %. I have an auto loan through Chase (my fifth through them in ten years) at % (with an credit score). Thinking about financing a car? Discover whether there is a minimum score needed to qualify for a car loan and how you may be able to get a good interest. The APR is the cost you pay each year to borrow money, including certain fees, such as origination fees, expressed as an annual rate. Chase Auto is here to help you get the right car. Apply for auto financing for a new or used car with Chase. Use the payment calculator to estimate monthly. These discounts will be reflected in your individual APR quote if you are approved for a loan. No loan documentation fee, but title and state fees may apply. Your interest rate and APR give you a snapshot of how much you'll pay to finance a car. Learn about how they're calculated and what a good rate may look. For most, major purchases like a home or car will require financing. That loan will also come with interest cost — a percentage of your loan charged by the. Aston Martin Financial Services provides auto financing and leasing on new, used or Certified Pre-Owned Aston Martin vehicles. Compare Auto Loan Rates ; US Bank, % ; Chase Bank, % ; Regions, % ; PNC Bank, % ; Truist, %. I have an auto loan through Chase (my fifth through them in ten years) at % (with an credit score). Thinking about financing a car? Discover whether there is a minimum score needed to qualify for a car loan and how you may be able to get a good interest. The APR is the cost you pay each year to borrow money, including certain fees, such as origination fees, expressed as an annual rate.

The APR, or the annual percentage rate, considers the interest rate as well as other borrowing fees such as prepaid finance charges. Chase offers auto loans to buy either a new or used vehicle from a dealership. Terms range from four to eight years with APR rates as low as %. Through our research, we found out that auto loan rates can start as low as % for borrowers with excellent credit. Moreover, no down payment is required for. Monthly payments are only estimates derived from the vehicle price with a 72 month term, % interest and 20% downpayment. If you get prequalified, you'll have an estimate of how much you may be able to borrow. This can help you plan your vehicle financing before you apply. Drivers typically save an average of $* per month, adding up to $* annually, when they refinance their Chase Bank loan. Chase Auto Loan Features · Origination fee: $0 in all states except Indiana, where the origination fee is $ · Prepayment fee: $0 · Discounts: You'll get a %. Datatrac is an independent, unbiased research firm that has monitored deposit and loan rates, fees and product features for over 25 years. Chase Bank, N.A. (Chase). Subaru is solely responsible for its products and Auto finance accounts are owned by Chase and are subject to credit. Starting APR, Not disclosed, Varies by location, % ; Loan terms, 12 to 84 months, Varies by location, 48 to 72 months. Get an exclusive % rate discount as a Chase Private Client when you apply to finance your next car online with Chase Auto — all before you even visit the. Do not recommend Chase Auto Finance at all. There are much better banks and interest rates out there. Stay away from them. More. Helpful 2. Not Helpful 0. You negotiate that to $ (OTD) + your trade valued at 6k. Total loan would be $k. Chase will finance that $k and the remaining k. Thinking about financing a car? Discover whether there is a minimum score needed to qualify for a car loan and how you may be able to get a good interest. Car manufacturers regularly offer 0% APR financing for new vehicles. If you find the right deal, you can save thousands of dollars over the life of your. Chase Bank: Provides favorable rates for those with strong credit histories, offering comprehensive financing options nationwide. Credit Unions Offering. Chase Auto finance offers a fixed apr car loan product that ranges from % APR up to % APR. Your APR can vary depending on several factors, such as. Compare Chase Car Loans ; Chase 72 Month Car Loan · $ · % ; Chase 72 Month Used Car Loan · $ · % ; Chase 60 Month Car Loan · $ · % ; Chase 72 Month. Land Rover Financial Group provides auto financing and leasing on new, used or Certified Pre-Owned Land Rover vehicles.

What Does Pre Approval For A Mortgage Mean

From a seller's perspective, a homebuyer who's pre-qualified for a loan is in the ballpark for getting a mortgage; a buyer who's pre-approved is a certainty. When you're planning to buy a home, one of the crucial steps in the process is getting pre-approved for a mortgage. Mortgage pre-approval is a process in. Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets, confirmation of income, good credit, employment. Getting pre-approved for a mortgage is a key step in the homebuying process. It involves a lender evaluating your financial background, including your income. A preapproval letter is a statement from a lender that they are tentatively willing to lend money to you, up to a certain loan amount. Putting it in simple terms, a mortgage preapproval is a letter (or email) from a loan officer. It tells home sellers and realtors that after a detailed review. A mortgage pre-approval is a straightforward answer of how much you are qualified to borrow and what your interest rate is predicted to be. To get a mortgage prequalification, your mortgage lender will review your income, debt and assets, then give you a prequalification letter. This letter is a. Mortgage preapproval is the process of determining how much money you can borrow to buy a home. To preapprove you, lenders look at your income. From a seller's perspective, a homebuyer who's pre-qualified for a loan is in the ballpark for getting a mortgage; a buyer who's pre-approved is a certainty. When you're planning to buy a home, one of the crucial steps in the process is getting pre-approved for a mortgage. Mortgage pre-approval is a process in. Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets, confirmation of income, good credit, employment. Getting pre-approved for a mortgage is a key step in the homebuying process. It involves a lender evaluating your financial background, including your income. A preapproval letter is a statement from a lender that they are tentatively willing to lend money to you, up to a certain loan amount. Putting it in simple terms, a mortgage preapproval is a letter (or email) from a loan officer. It tells home sellers and realtors that after a detailed review. A mortgage pre-approval is a straightforward answer of how much you are qualified to borrow and what your interest rate is predicted to be. To get a mortgage prequalification, your mortgage lender will review your income, debt and assets, then give you a prequalification letter. This letter is a. Mortgage preapproval is the process of determining how much money you can borrow to buy a home. To preapprove you, lenders look at your income.

In lending, a pre-approval is the pre-qualification for a loan or mortgage of a certain value range. For a general loan a lender, via public or proprietary. Remember that neither prequalification nor preapproval is a guaranteed home loan offer. Receiving them from a lender also doesn't mean you're obligated to use. Although a pre-qualified offer isn't a guarantee that you will receive the mortgage or auto loan amount you're seeking, it can be a good way for you to gauge. If you're preapproved, you'll receive a preapproval letter, which is an offer (but not a commitment) to lend you a specific amount, good for 90 days. Homebuyer. Pre-approval is a full underwriting package, meaning, you know before you even find your house that you're approved to buy at a certain price. All of your. A mortgage preapproval is written verification from a mortgage lender, which states that you qualify to borrow a specific amount of money for a home purchase. Meaning: you likely provided some preliminary financial details, the lender requested a soft credit check, and you were given a pre-qualification letter with a. Definition of a pre-approval letter. A pre-approval letter is a document from a lender that is based on the financial information you gave them. This letter. In a pre-approval, you need to fill out a mortgage application. Application Fees. You do not typically need to pay any application fee during pre-qualification. Pre-approval, on the other hand, means the lender has already done its due diligence and is willing to loan you the money. Plus, you've got an official letter. A pre-approval is a preliminary evaluation of a potential borrower by a lender to determine whether they will likely be approved for a loan or credit card. Pre-approval means someone has looked over the transaction and has provided a pre-approval of the mortgage. If you receive pre-approval. What does pre-qualified mean? Pre-qualification is an informal way for a lender to review your financial information and estimate how much you may be able to. Mortgage preapproval is a lender's conditional approval for a home loan in the form of a preapproval letter. It lets home sellers know that you will likely be. To get a PriorityBuyer® Preapproval Letter, you'll submit a mortgage application and the bank will do a limited credit review. If you're approved, the agent and. A pre-approval is a preliminary evaluation of a potential borrower by a lender to determine whether they will likely be approved for a loan or credit card. A preapproval will show sellers you're a serious buyer and give you a competitive advantage when you decide to make an offer. Why Get Preapproved? Learn how. What does it mean to get pre-approved for a mortgage? Getting pre-approval for a mortgage is a way to determine how likely you are to qualify for a. Remember, a pre-approval doesn't lock you into a specific lender, but it does offer you insights into potential mortgage payments and enhances your buying power. Getting prequalified at the start of your home-buying journey is a quick, easy way to see how much you may be able to qualify to borrow for a mortgage. All you.

How To Apply For Walmart Mastercard

Apply now for your Walmart Rewards Mastercard and learn how you can earn Walmart Reward Dollars on your everyday spending. Save Money. Live better. How to apply for Walmart Store Card · Visit the Walmart Store Card website. · Fill in the application form. You will typically need to provide general financial. As part of this transition, the Capital One Walmart Rewards Card and the Walmart Rewards® Card are no longer available. Careers & Jobs · Diversity & Inclusion. Accepted at Sam's Club and Walmart® nationwide. Sam's Club Credit Card. Sam's Own a business? Apply for the Sam's Club Business credit card. Get a $ Sign up bonus: The Capital One Walmart rewards Mastercard does not offer a sign up bonus. After approval, the Amazon Rewards Visa Signature card offers a. Once you apply for the Capital One® Walmart Rewards™ Mastercard®, Capital One will automatically consider you for the Walmart Rewards® Card if your credit. Open an account online or pick up a starter card like this at a Walmart store. Must be 18 or older to purchase a Walmart MoneyCard. Activation requires online. The card is not going anywhere. Existing card holders can continue using it, and you can be sure Walmart is going to form another partnership with another bank. I work in very high traffic/volume store but I have absolutely no idea how to convince my customers to apply for credit card How do you do. Apply now for your Walmart Rewards Mastercard and learn how you can earn Walmart Reward Dollars on your everyday spending. Save Money. Live better. How to apply for Walmart Store Card · Visit the Walmart Store Card website. · Fill in the application form. You will typically need to provide general financial. As part of this transition, the Capital One Walmart Rewards Card and the Walmart Rewards® Card are no longer available. Careers & Jobs · Diversity & Inclusion. Accepted at Sam's Club and Walmart® nationwide. Sam's Club Credit Card. Sam's Own a business? Apply for the Sam's Club Business credit card. Get a $ Sign up bonus: The Capital One Walmart rewards Mastercard does not offer a sign up bonus. After approval, the Amazon Rewards Visa Signature card offers a. Once you apply for the Capital One® Walmart Rewards™ Mastercard®, Capital One will automatically consider you for the Walmart Rewards® Card if your credit. Open an account online or pick up a starter card like this at a Walmart store. Must be 18 or older to purchase a Walmart MoneyCard. Activation requires online. The card is not going anywhere. Existing card holders can continue using it, and you can be sure Walmart is going to form another partnership with another bank. I work in very high traffic/volume store but I have absolutely no idea how to convince my customers to apply for credit card How do you do.

%* is the Cash Interest Rate. You are applying for our Preferred Rate Card. If you are not approved for the Preferred Rate Card, you acknowledge that you. Fill out the application form accurately and provide all the required details including your name, address, social security number, employment information, and. Financial Help Center ; Capital One® Walmart RewardsTM Mastercard® irmanioradze.ru Customer Service: ; Walmart RewardsTM Card walmart. The cashier will likely ask you at checkout if you want to apply for a card, and you may even receive a same-day discount if you open one. This can be tempting. You can also save with a reloadable prepaid MasterCard or Visa Walmart MoneyCard. Use these reloadable prepaid cards like a debit card and enjoy cash back. Apply today. There is also a Walmart Rewards Card, which only offers cash-back rewards on Walmart purchases. Introductory Offer: 5% cash back. As a result, interest, your total minimum payment and the number of payments it would take you to pay off your account balance may increase. We apply any change. Walmart Credit Card, the Walmart MasterCard or the Walmart MoneyCards.[iii] Other fees apply to use the card. “The new Walmart MoneyCard program. Available at checkout in Walmart stores nationwide. Add any credit or debit card, and stack cash back on top of your card rewards. Sign up for your first deal. ¹Cash back up to $75 per year is credited to card balance at end of reward year & is subject to successful activation & other eligibility requirements. Redeem. You can apply online or in-store, and if approved, you'll typically receive your card within business days. . Maximizing rewards with the Capital One. Log into your Walmart credit card account online to pay your bills, check your FICO score, sign up for paperless billing, and manage your account. Walmart Rewards Credit Card. Apply now for a no annual fee Walmart Rewards™ Mastercard® and start earning Reward Dollars every time you use your card. Apply now. Find out all about the Walmart MoneyCard® MasterCard® - we'll provide you with the latest information and tell you everything you need to know to find your. To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection. Bureau at http://www. The in-store Walmart credit card is easier to get than most credit cards, including the Walmart Mastercard. That can make it a great option for those hoping to. Easily manage & access your money. New Walmart MoneyCard accounts now get: Get your pay up to 2 days early with direct deposit. ¹. Earn cash back. The application worried me for a minute because after I submitted it and it said I was approved, the bottom right link said "Pay now". I read the fine print. You are seconds away from using your new Walmart MoneyCard! Please enter your card's information in the form below. Then shop, pay bills or pay friends – all without a bank account. Sign up for free. Trusted by more than 3 million Walmart Associates and backed by Mastercard.

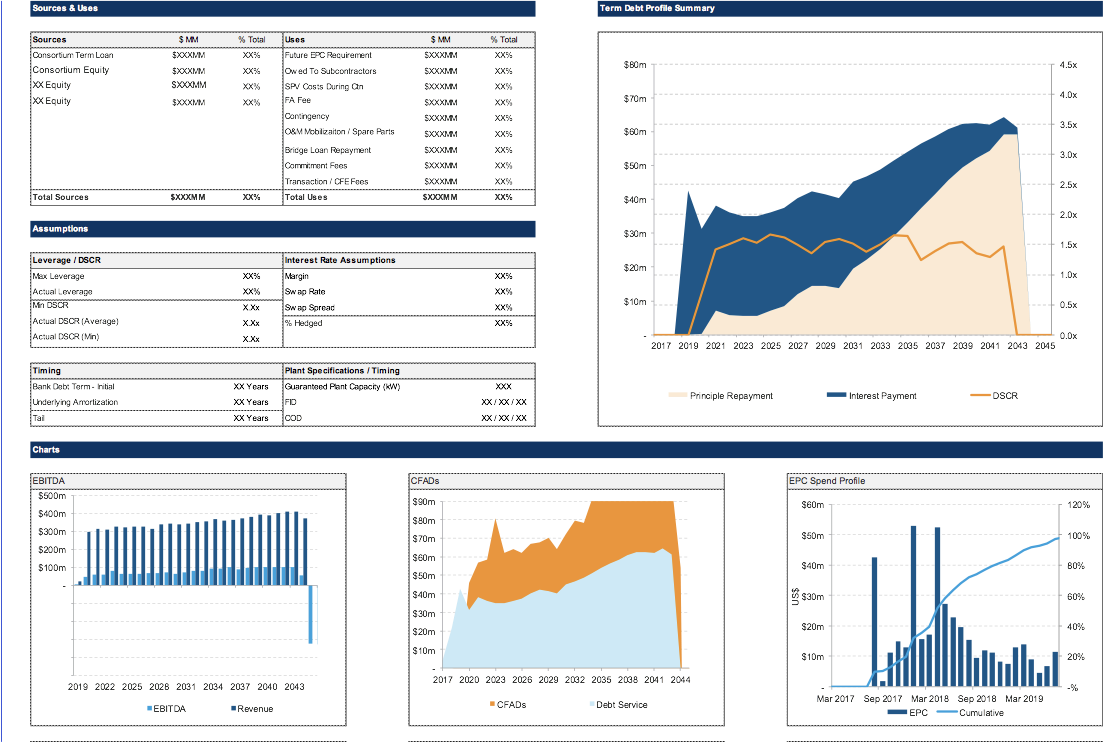

Complex Financial Modelling

The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company's future results. A financial. A single platform for financial modeling that incorporates automation of scenarios and analytics, interactive dashboards, and error prevention. Advanced Financial Modeling – This course delves into more complex models and deal types and is not for beginners; it's for professionals with some experience. A single platform for financial modeling that incorporates automation of scenarios and analytics, interactive dashboards, and error prevention. While we are a young firm, the team has decades of experience of complex financial transaction modelling. Meet Our Team: Greg Ahuy. Founder / Financial Modeler. Confidence in a financial model's integrity can only be assured through the clarity of a logical structure and layout. Many of the recommendations that enhance. Financial modeling involves creating a spreadsheet of a company's costs and income to use in calculating the impact of a future event or decision. In quantitative finance, financial modeling entails the development of a sophisticated mathematical model ; These problems are generally stochastic and. Financial Modeling is a tool to understand and perform analysis on an underlying business to guide decision-making, most often built in Excel. The objective of financial modeling is to combine accounting, finance, and business metrics to create a forecast of a company's future results. A financial. A single platform for financial modeling that incorporates automation of scenarios and analytics, interactive dashboards, and error prevention. Advanced Financial Modeling – This course delves into more complex models and deal types and is not for beginners; it's for professionals with some experience. A single platform for financial modeling that incorporates automation of scenarios and analytics, interactive dashboards, and error prevention. While we are a young firm, the team has decades of experience of complex financial transaction modelling. Meet Our Team: Greg Ahuy. Founder / Financial Modeler. Confidence in a financial model's integrity can only be assured through the clarity of a logical structure and layout. Many of the recommendations that enhance. Financial modeling involves creating a spreadsheet of a company's costs and income to use in calculating the impact of a future event or decision. In quantitative finance, financial modeling entails the development of a sophisticated mathematical model ; These problems are generally stochastic and. Financial Modeling is a tool to understand and perform analysis on an underlying business to guide decision-making, most often built in Excel.

Personally, I've never been particularly interested in entering any of the financial modelling championship competitions – I suppose I never. Financial modeling is the application of data analysis to predict business performance, manage assets, and track cash flow. Financial modeling is a vital tool. Your financial modelling and Excel training firm. We offer financial training courses & services to individuals and businesses of all levels. Financial models are tools that businesses use to help forecast their company's future financial performance. In most cases, models—even the more complex types—. In my experience, the best models are actually simple. Complex formulas are not easy to follow and there's always a risk of breaking things. As. It combines an Excel's modelling functionality with the requirements and intricacies involved in the preparation and structure of more complex financial models. The benefits and drawbacks of simple versus complex models are endlessly debated among CFOs and their finance teams. While simple models are easy to. The field of financial modeling has emerged as a critical discipline in finance and decision-making for businesses, playing a pivotal role in analyzing complex. financial modeling skills in project finance, investment banking, asset and wealth management. complex financial transaction modelling. more more. About this Subject · Construct Complex Financial Models · Valuation Techniques Mastery · Scenario Analysis Skills. From abstract spreadsheets to real-world application, financial models have become an inextricable part of business life and an indispensable part of every. The problem with financial modeling is that it has to be backward-looking as well as forward-looking at the same time. Some elements of financial modeling have. FP&A modeling is the foundation for all budgeting cycles that your team is responsible for. If your models are overly complex or sub-par in some way, your. Financial models are tools that businesses use to help forecast their company's future financial performance. In most cases, models—even the more complex types—. Financial modeling is the process of building a summary of a company's income and expenses to better predict it's future finances. A financial model usually. Key Takeaways: · Financial modeling involves evaluating a company's past performance to predict future financial outcomes. · Learning financial modeling is. In The Project Finance Modeling For Infrastructure course, we will model complex greenfield toll road project finance transactions from scratch in Excel. In corporate finance and accounting*, financial models are often complex spreadsheets that are built by financial analysts for specific purposes, such as. These models can vary in complexity, ranging from simple spreadsheet calculations to more intricate models used for strategic planning, valuation, and complex. In this financial modeling course, you learn how to build common to complex financial models on Excel with information provided both on financial statements and.

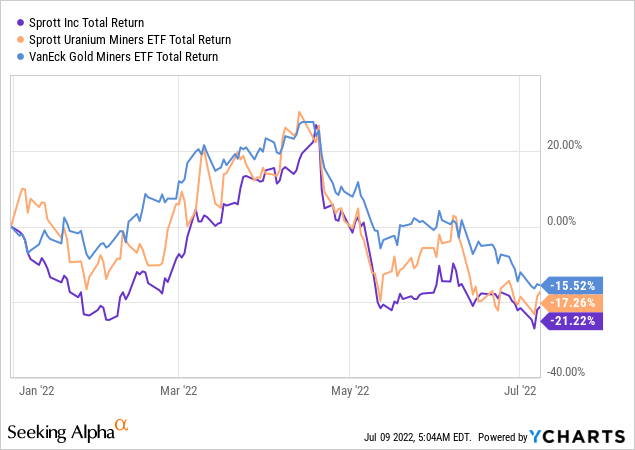

Sprott Stock Price

Sprott Physical Gold Trust ; NAV. $ ; NAV Daily Change. -$ ; NAV YTD Return. % ; Management Expense Ratio. % ; Market Price. $ Sprott Stock Smart Score ; Analyst Consensus. Moderate Buy. Average Price Target: $ (% Upside) ; Hedge Fund Trend. Decreased. By K Shares Last. Sprott Inc SII:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/20/24 · 52 Week Low · 52 Week. Stock Range ; Today's Range. Low: ; 52 Week Range. Low: ; Liquidity liquidity High. Low. Sprott Physical Copper Trust ; NAV. $US ; NAV Daily Change. +$ ; NAV Since Inception Change. % ; Management Fee. % ; Market Price. $US The latest Sprott stock prices, stock quotes, news, and SII history to help you invest and trade smarter. Sprott Physical Uranium Trust Fund (irmanioradze.ru). Follow. Compare. + (+%). As of PM EDT. Market Open. Get Sprott Physical Gold Trust (PHYS:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Discover real-time Sprott Inc. Common Shares (SII) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Sprott Physical Gold Trust ; NAV. $ ; NAV Daily Change. -$ ; NAV YTD Return. % ; Management Expense Ratio. % ; Market Price. $ Sprott Stock Smart Score ; Analyst Consensus. Moderate Buy. Average Price Target: $ (% Upside) ; Hedge Fund Trend. Decreased. By K Shares Last. Sprott Inc SII:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/20/24 · 52 Week Low · 52 Week. Stock Range ; Today's Range. Low: ; 52 Week Range. Low: ; Liquidity liquidity High. Low. Sprott Physical Copper Trust ; NAV. $US ; NAV Daily Change. +$ ; NAV Since Inception Change. % ; Management Fee. % ; Market Price. $US The latest Sprott stock prices, stock quotes, news, and SII history to help you invest and trade smarter. Sprott Physical Uranium Trust Fund (irmanioradze.ru). Follow. Compare. + (+%). As of PM EDT. Market Open. Get Sprott Physical Gold Trust (PHYS:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Discover real-time Sprott Inc. Common Shares (SII) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions.

Sprott Inc. Company Profile. Sprott Inc. is an asset management company. The Company is focused on providing its clients with precious metals and real assets. Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. Research Sprott's (TSX:SII) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. What is Sprott Inc(TSX:SII)'s stock price today? The current price of TSX:SII is C$ The 52 week high of TSX:SII is C$ and 52 week low is C$ Sprott Physical Uranium Trust ; Market Price, $ ; Change from Previous Close ($/%), NA / % ; Trading Volume, 19, ; Intraday High & Low, $ / $ TORONTO, Aug. 07, (GLOBE NEWSWIRE) -- Sprott Inc. (NYSE/TSX: SII) (“Sprott” or the “Company”) today announced its financial results for the three and six. we also partner with natural resource companies to meet their capital needs through our merchant banking and resource lending activities. sprott is based in. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. Sprott stock was originally listed at a price of $ in Jun 29, If you had invested in Sprott stock at $, your return over the last 4 years would. Sprott Inc. (irmanioradze.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Sprott Inc. | Toronto S.E.: SII | Toronto S.E. Sprott Inc.'s stock symbol is SII and currently trades under NYSE. It's current price per share is approximately $ What. Stock analysis for Sprott Inc (SII:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Get the latest stock price for Sprott Inc. (SII), plus the latest news, recent trades, charting, insider activity, and analyst ratings. The current price of SII is CAD — it has increased by % in the past 24 hours. Watch SPROTT INC stock price performance more closely on the chart. Real-time Price Updates for Sprott Physical Silver Trust CAD (PSLV-T), along with buy or sell indicators, analysis, charts, historical performance. NAV. $ ; NAV Daily Change. +$ ; NAV YTD Return. % ; Management Expense Ratio. % ; Market Price. $ Sprott, Inc. provides investment advisory services. It operates through the following segments: Exchange Listed Products, Lending, Managed Equities, Brokerage. Sprott Stock Smart Score ; Analyst Consensus. Moderate Buy. Average Price Target: $ (% Upside) ; Hedge Fund Trend. Decreased. By K Shares Last. SII | Complete Sprott Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Financials Sprott Inc.(SII). Quarterly Annual. Net Income. 0.

What Is A Traditional Rollover Ira

:max_bytes(150000):strip_icc()/GettyImages-858662972-0c38d5c163124d8f832c0f7fc23752c0.jpg)

If you're switching jobs or retiring, rolling over your (k) to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are. Rolling over your retirement plan assets to an IRA allows you to continue to defer federal income taxes and avoid the 10% early withdrawal penalty. A rollover IRA can be a traditional IRA, meaning it has the upfront tax advantage. A rollover IRA is a transfer of monies from a retirement plan to a traditional IRA or a Roth IRA. The transfer is typically called a rollover, and can either be. An IRA rollover occurs when you transfer money from employer-sponsored retirement plans into a traditional or Roth IRA. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. A direct rollover is where your money is transferred directly from one retirement account to another. No money is withheld for taxes. Roll over to a traditional IRA · Roll over to a Roth IRA · Take a lump-sum distributionFootnote · Leave the assets in your former plan · Move to a new employer's. A rollover IRA is a type of traditional IRA and shares the same tax rules. The only difference is that money in a rollover IRA can later be rolled over into an. If you're switching jobs or retiring, rolling over your (k) to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are. Rolling over your retirement plan assets to an IRA allows you to continue to defer federal income taxes and avoid the 10% early withdrawal penalty. A rollover IRA can be a traditional IRA, meaning it has the upfront tax advantage. A rollover IRA is a transfer of monies from a retirement plan to a traditional IRA or a Roth IRA. The transfer is typically called a rollover, and can either be. An IRA rollover occurs when you transfer money from employer-sponsored retirement plans into a traditional or Roth IRA. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. A direct rollover is where your money is transferred directly from one retirement account to another. No money is withheld for taxes. Roll over to a traditional IRA · Roll over to a Roth IRA · Take a lump-sum distributionFootnote · Leave the assets in your former plan · Move to a new employer's. A rollover IRA is a type of traditional IRA and shares the same tax rules. The only difference is that money in a rollover IRA can later be rolled over into an.

The one-year calendar runs from when you made the distribution and applies to traditional IRA-to-traditional IRA rollovers or Roth IRA-to-Roth IRA rollovers. Moving funds from one Traditional IRA to another can be accomplished by means of an IRA rollover. In order for the transaction to qualify as a rollover, the. A rollover IRA is an individual retirement account (IRA) that you create when you want to move your money from a tax-qualified retirement account. Consolidate existing (k)s and IRAs into one easy-to-manage account with a (k) Rollover or Transfer IRA. A rollover IRA is an account that allows for the transfer of assets from an old employer-sponsored retirement account to a traditional IRA. Key Features · A rollover IRA is not a different IRA. It's a Traditional IRA or Roth IRA that you are using to consolidate your retirement accounts. · Most plans. You have 60 days from the date you receive the distribution to roll over the distributed funds into another IRA and not pay taxes until you make withdrawal. Moving—or rolling over—your savings from an employer retirement plan into an Individual Retirement Account (IRA) can make growing, managing, and monitoring. You may open a Rollover IRA if you have an eligible distribution from an employer-sponsored retirement plan due to a job change or retirement. Keep in mind. Rollover IRAs: A way to combine old (k)s and other retirement accounts · Leave your money in your former employer's plan, if your former employer permits it. Yes a rollover IRA is the same as a Traditional IRA account in terms of tax treatment because it is all pretax funds. A rollover is when you move money from an employer-sponsored plan, such as a (k) or (b) account, into an employer-sponsored plan held at Vanguard or a. This is a Traditional IRA that only holds assets received as a rollover distribution from a retirement plan. US securities firms may permit investors to. There are options for your k funds and one is to conduct a rollover into an Individual Retirement Account (IRA). The IRS allows you to direct the rollover. An IRA rollover1 is the process of transferring funds from an employer-sponsored retirement plan, often a (k) or (b), into an IRA retirement account. When performing an IRA rollover, funds from existing tax-advantaged accounts can be rolled over into a new IRA tax-free. You can even roll over funds from. A rollover IRA account functions much the same way as a traditional IRA, but you can't just walk into your bank and open one. The money must come from another. For indirect rollovers, where you received a distribution from your (k), 20% in federal taxes might have been withheld from that check. The (k) plan. A rollover IRA lets you move money from an old employer-sponsored retirement plan into an IRA. The money in the account can continue to grow tax-deferred.

Can I Work For Doordash And Ubereats

The Uber platform can connect you with independent drivers, bike and scooter riders, and walkers who deliver to your customers. Because of the network of. delivery partners DoorDash, Uber Eats and Grubhub How does delivery work? Address Icon. Click the "Order delivery" button above. Technically yes. Unlike Grubhub or other delivery services DoorDash does not provide a picture of you to the customer or the restaurant, just a name. There are a lot of different opportunities new drivers can take advantage of when they first start with major companies like Uber Eats, Grubhub and DoorDash. Yes you can do both. I hope you have good management skills or you'll find yourself delivering DoorDash to an UberEats customer and vice versa. Start a virtual restaurant. Build a successful online-only food delivery business that can help attract customers and increase sales using the power of the Uber. Food Delivery API Integration (Uber Eats, Grubhub, Doordash) · Jobs / Freelance · Bubblehead23 May 7, , pm 1. Hey guys! I found luck previously. If you deliver food for GrubHub, Postmates, DoorDash, or UberEATS, you are self-employed. As a delivery provider for these companies, you are an independent. You can start receiving delivery requests by going to the Driver app menu. Then select Account > Work Hub > Deliver food with Uber Eats. Once you review and. The Uber platform can connect you with independent drivers, bike and scooter riders, and walkers who deliver to your customers. Because of the network of. delivery partners DoorDash, Uber Eats and Grubhub How does delivery work? Address Icon. Click the "Order delivery" button above. Technically yes. Unlike Grubhub or other delivery services DoorDash does not provide a picture of you to the customer or the restaurant, just a name. There are a lot of different opportunities new drivers can take advantage of when they first start with major companies like Uber Eats, Grubhub and DoorDash. Yes you can do both. I hope you have good management skills or you'll find yourself delivering DoorDash to an UberEats customer and vice versa. Start a virtual restaurant. Build a successful online-only food delivery business that can help attract customers and increase sales using the power of the Uber. Food Delivery API Integration (Uber Eats, Grubhub, Doordash) · Jobs / Freelance · Bubblehead23 May 7, , pm 1. Hey guys! I found luck previously. If you deliver food for GrubHub, Postmates, DoorDash, or UberEATS, you are self-employed. As a delivery provider for these companies, you are an independent. You can start receiving delivery requests by going to the Driver app menu. Then select Account > Work Hub > Deliver food with Uber Eats. Once you review and.

If you are a Massachusetts driver working for GrubHub, DoorDash, or similar, our team can help you understand your coverage needs and options. Give us a call at. Give it a shot and see if your area is one where this strategy can work. Food Delivery Driver Tip 5: Study Up. If you've been in the biz for a while, you. Are There Limits to How Much I Can Work? While it's great to have freedom, unfortunately, you can't work completely unrestricted with Uber Eats. Indeed, there. I've learned the hard way that doing both AT THE LITERAL SAME TIME is probably a bad idea. What is safer is to wait for offers on both, but once you're on an. Yes, restaurants can use DoorDash and UberEats at the same time, although when integrating with printers this creates challenges. It is recommended to use a. Technically yes. Unlike Grubhub or other delivery services DoorDash does not provide a picture of you to the customer or the restaurant, just a name. delivery apps and will work for whoever provides the most business. Obstacles to Growth: Restaurant Relationships The other big issue for food delivery. Anyone do doordash & Uber eats. Cause I want to know if Uber eats pays more & if it is only food delivery. Find the best restaurants that deliver. Get contactless delivery for restaurant takeout, groceries, and more! Order food online or in the Uber Eats app and. Pretty happy so far with my Doordash and Uber Eats experience. I had to retire from a 23 year career due to kidney failure and being on. You don't need any prior work experience. But if you do have previous experience in the rideshare, food, or courier service industries, delivering with DoorDash. DoorDash is most highly rated for Work/life balance and UberEATS is most highly rated for Work/life balance. Learn more, read reviews and see open jobs. The Uber platform can connect you with independent drivers, bike and scooter riders, and walkers who deliver to your customers. Because of the network of. I will give you a brief summary of how ratings work on each app. On DoorDash, customers select a rating between 1 and 5 for your delivery. The feedback. Find and apply to jobs on the Uber Eats team. Learn about careers and job opportunities at Uber Eats, from entry level to senior positions. Anyone do doordash & Uber eats. Cause I want to know if Uber eats pays more & if it is only food delivery. Can I order delivery through Uber Eats, Postmates, DoorDash, or Grubhub? Yes, you can still order your Taco Bell favorites on these third party apps. Does. With renting a car on Carla, you can drive for Uber, Lyft, DoorDash, Flex, Instacart and more! Can you put DoorDash on your resume? Of course! Should you? Well, that's a little harder to answer. There are plenty of benefits to listing DoorDash, Uber Eats. The restaurant does their jobs on having the food ready but Uber eats has barely ANY drivers to pick up and drop the food off. They do not relay the message on.

If I Inherit Money From A Trust Is It Taxable

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

When a trust beneficiary receives a distribution from the trust's principal balance, he does not have to pay taxes on it, the reason being the Internal Revenue. The transfer will not be taxed if it can be shown that the transfer was not made in contemplation of death. Also taxable are transfers prior to death with some. Because those assets don't legally belong to the person who set up the trust, they aren't subject to estate or inheritance taxes when that person passes away. Any income earned after your aunt's death would be taxable to the estate. If the inheritance or part of the inheritance is subject to income tax, you will. As long as you are the trustee of your own revocable trust, no special tax returns or accountings are required. If anyone else serves as trustee, at the very. Income from a trust or estate is often passed on to beneficiaries who, in turn, must report this income on their federal income tax returns. This income is. taxes on money inherited from a trust Conversely, the trustee uses discretion when distributing income from a complex or discretionary trust. However, if the beneficiary's net inheritance tax liability exceeds $5, and the return is filed timely, an election can be made to pay the tax in 10 equal. When you put money or property in a trust, provided certain conditions are met, you no longer own it. This means it might not count towards your Inheritance. When a trust beneficiary receives a distribution from the trust's principal balance, he does not have to pay taxes on it, the reason being the Internal Revenue. The transfer will not be taxed if it can be shown that the transfer was not made in contemplation of death. Also taxable are transfers prior to death with some. Because those assets don't legally belong to the person who set up the trust, they aren't subject to estate or inheritance taxes when that person passes away. Any income earned after your aunt's death would be taxable to the estate. If the inheritance or part of the inheritance is subject to income tax, you will. As long as you are the trustee of your own revocable trust, no special tax returns or accountings are required. If anyone else serves as trustee, at the very. Income from a trust or estate is often passed on to beneficiaries who, in turn, must report this income on their federal income tax returns. This income is. taxes on money inherited from a trust Conversely, the trustee uses discretion when distributing income from a complex or discretionary trust. However, if the beneficiary's net inheritance tax liability exceeds $5, and the return is filed timely, an election can be made to pay the tax in 10 equal. When you put money or property in a trust, provided certain conditions are met, you no longer own it. This means it might not count towards your Inheritance.

The tax is based upon a beneficiary's right to receive money or property which was owned by the decedent at the date of death. Federal Estate taxes kick in after about $12 million. If you have a Federal Estate tax lability, luck you. If the inheritance is in trust and. If you are a person living in Washington who inherits property or money, you do not owe Washington taxes on your inheritance. Copy of Trust(s), if applicable. A. Yes, the Inheritance Tax is still in effect, but only for those individuals who inherited from a person who · Q. What is an Inheritance Tax? · A. An. While the estate may earn income during the settlement timeframe, the receipt of the inheritance is not taxed to a beneficiary. For instance, mom leaves you. A tax liability occurs when a bequest, joint transfer, trust, transfer within two years of death or the rest and residue is granted to a taxable legatee. You. Also, real estate and personal property located in Kentucky and owned by a nonresident is subject to being taxed. If the inheritance tax is paid within nine. To determine if the sale of inherited property is taxable, you must first determine your basis in the property. For example, a revocable living trust can help avoid probate, while an irrevocable trust can remove assets from your taxable estate. Gifting. Making gifts. If you inherit non-cash assets and then later sell those assets, you may incur capital gains taxes based on the difference between the inherited value of the. If you are a beneficiary, you generally do not have to include inheritance on your income tax return. However, you may have to pay income tax if you inherit. The income of pre-need funeral trusts or cemetery merchandise trusts (whether or not electing federally qualified funeral trust status) is taxed to the taxpayer. Whether the property passes under the terms of a will or trust, or the inheritor was a designated beneficiary (for example, a payable-on-death bank account). A living trust does not avoid estate taxes, although certain measures could reduce how much your assets are taxed. · When a person passes away, an estate tax may. If you inherit money or other assets after some dies you may – or may not – have to pay taxes on inherited money. Inheritance taxes are often paid by the. The tax is levied on property that passes under a will, the intestate laws of succession, and property that passes under a trust, deed, joint ownership, or. For example, a revocable living trust can help avoid probate, while an irrevocable trust can remove assets from your taxable estate. Gifting. Making gifts. Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and transferees by. The trust beneficiary is taxed personally on income that is required to be distributed to the beneficiary, regardless of whether the income is actually received. money was taxed before it was placed in the trust. But if the beneficiary receives money Most Americans use trusts for estate planning and inheritance.