irmanioradze.ru Community

Community

Healthcare House Loan

Our specialty mortgage loans for medical professionals, sometimes known as a doctor home loan program or nurse practitioner mortgage loans, streamlines the. A physician or “doctor” mortgage is a special loan program a lender puts in place to attract high-income clients by allowing health care professionals such as. Homebuying program for healthcare workers in Denver, CO. No down payment home loans for nurses and doctors + $ closing cost credit. We offer competitive rates and terms, as well as fast, friendly and personal service. We can pre-approve your home loans so your house shopping experience will. The Ohio Housing Finance Agency's (OHFA) Ohio Heroes rewards Ohio residents who serve the public with a discounted mortgage interest rate. 2. Healthcare Workers Can Avail Of Government-Backed Housing Loans mortgages are being offered by the Federal Housing Authority (FHA) and the US Department of. We have special home loan solutions for licensed and practicing doctors and dentists, medical residents and fellows, and other eligible medical professionals. As part of Next Door Programs®, the largest national home buying program in the U.S., Nurse Next Door®is designed specifically for nurses and healthcare workers. USDA home loans have several advantages for healthcare workers. The first advantage is the lack of a down payment requirement. USDA loans require no money down. Our specialty mortgage loans for medical professionals, sometimes known as a doctor home loan program or nurse practitioner mortgage loans, streamlines the. A physician or “doctor” mortgage is a special loan program a lender puts in place to attract high-income clients by allowing health care professionals such as. Homebuying program for healthcare workers in Denver, CO. No down payment home loans for nurses and doctors + $ closing cost credit. We offer competitive rates and terms, as well as fast, friendly and personal service. We can pre-approve your home loans so your house shopping experience will. The Ohio Housing Finance Agency's (OHFA) Ohio Heroes rewards Ohio residents who serve the public with a discounted mortgage interest rate. 2. Healthcare Workers Can Avail Of Government-Backed Housing Loans mortgages are being offered by the Federal Housing Authority (FHA) and the US Department of. We have special home loan solutions for licensed and practicing doctors and dentists, medical residents and fellows, and other eligible medical professionals. As part of Next Door Programs®, the largest national home buying program in the U.S., Nurse Next Door®is designed specifically for nurses and healthcare workers. USDA home loans have several advantages for healthcare workers. The first advantage is the lack of a down payment requirement. USDA loans require no money down.

*% financing available on purchase transactions of a single family detached, primary residence; a maximum loan amount of $1,, for credit scores up to. This one-of-a-kind account can help your staff earn bonus rates on CDs and IRAs, get loan discounts, and save on ATM fees. house icon. Mortgages. Medical. Unlock exclusive homeownership opportunities with the Nick Barta Team's Healthcare Heroes Program in Colorado. Whether you're a nurse, doctor, technician. But being a healthcare professional can have its drawbacks, too–especially when it comes to mortgages. Banks and other lenders can see “flexible” schedules as. At National Home Loans, we honor currently employed doctors, nurses, nurse practitioners, medical technicians, medical assistants, physical therapists, dentists. These programs can range from 3% to 5% in down payment and closing cost help. Additionally, there's a program that can even help you pay off your student loan. At The Home Loan Expert, we appreciate the hard work and sacrifices of our first responders. Firefighters, police officers, emergency medical personnel. I've heard about loans for healthcare workers but I'll admit I haven't done much research into whether they are beneficial and if we can qualify as PTs. Our Homes for Texas Heroes Program offers home loans and down payment assistance for teachers, first responders, corrections officers, and veterans. TD Bank Medical Professional Mortgage. If you're a doctor, dentist, resident or fellow who is less than 10 years out of residency, you may qualify for a TD Bank. Healthcare Employee Mortgage Program · NO Private Mortgage Insurance (PMI) · Up to % Financing · Up to $ off Closing Cost · Donation to Employers. We specialize in home loans for healthcare workers to help overcome those obstacles. Our goal is to make mortgage loans more accessible and achievable. Table of contents · Healthcare professionals have stable incomes, making them low-risk for home loans. · Many healthcare professionals, such as doctors and. Official website of the Nurse Next Door Program. Grants, down payment assistance, home loans and other special programs for nurses and healthcare workers. Healthcare Home. funds-submenu-row-container. Benefits. Medical and Home First Forgivable Loan. As part of former Mayor Bloomberg's “New Housing. Purchase ANY home on the market; GRANTS up to $8,; Down Payment Assistance up to $15,; Home loans for first time home buyers; Dedicated Buyers Agent. The Florida Hometown Heroes Loan Program also offers a lower first mortgage interest rate and additional special benefits to those who have served and continue. AHCU has the home loans you need at competitive interest rates. Best of all, we have the expert staff and reliable resources to help you through this. mortgage loan. Step 2: After receiving pre-approval from a participating lender, consult a reputable real estate professional to identify an affordable home. Actively practicing medical doctors, dentists, dental surgeons or veterinarians can finance the entire purchase price of a home with no down payment.

Sb Partners Real Estate Corporation

SB Partners is engaged in acquiring, operating and holding for investment in a varying portfolio of real estate interests. As of December 31, , the Company. A real estate broker is any person, partnership, limited partnership, limited liability company, association, professional corporation, or corporation, foreign. Founded in , SB Real Estate Partners ("SBREP") is a multifamily investment firm committed to acquiring and asset managing value-add investments. Financial One Mortgage Corporation. (4 reviews). Kara C. said: Micheal Photo of Frank Swiatek - Keller Williams Capital Partners. Frank Swiatek. QuadReal Property Group. Harry Lewis. Reflect Investment Management. Jas Chahal. Rock Lake Advisors. Alessandro Bronda. SB Capital Partners. Sanjeet Bhavani. SB Partners, Sentinel Real Estate Corporation, and Annette. McClanahan ("Respondents") alleging that they had engaged in discriminatory practices on the. SB PARTNERS, LTD. Filing Information Document Number A FEI/EIN Number Date Filed 11/19/ State NY Status INACTIVE. properties, real estate investments. Proposed Changes. The government is concerned that investing through a corporation creates an opportunity for much more. SB Partners, a New York limited partnership, and its subsidiaries (collectively, the "Partnership" or the "Registrant"), have been engaged since April in. SB Partners is engaged in acquiring, operating and holding for investment in a varying portfolio of real estate interests. As of December 31, , the Company. A real estate broker is any person, partnership, limited partnership, limited liability company, association, professional corporation, or corporation, foreign. Founded in , SB Real Estate Partners ("SBREP") is a multifamily investment firm committed to acquiring and asset managing value-add investments. Financial One Mortgage Corporation. (4 reviews). Kara C. said: Micheal Photo of Frank Swiatek - Keller Williams Capital Partners. Frank Swiatek. QuadReal Property Group. Harry Lewis. Reflect Investment Management. Jas Chahal. Rock Lake Advisors. Alessandro Bronda. SB Capital Partners. Sanjeet Bhavani. SB Partners, Sentinel Real Estate Corporation, and Annette. McClanahan ("Respondents") alleging that they had engaged in discriminatory practices on the. SB PARTNERS, LTD. Filing Information Document Number A FEI/EIN Number Date Filed 11/19/ State NY Status INACTIVE. properties, real estate investments. Proposed Changes. The government is concerned that investing through a corporation creates an opportunity for much more. SB Partners, a New York limited partnership, and its subsidiaries (collectively, the "Partnership" or the "Registrant"), have been engaged since April in.

Jim Bringley is an expert in small business finance. He spent thirty years at South Shore Bank in Chicago. Jim ran the Bank's real estate lending department and. Real Estate. Career History. title. company. tenure. Partner. SB Partners. PRESENT. Education. degree. institution. Bachelor's Degree. University of Waterloo. Schottenstein's deep knowledge of operations, apparel retail, real estate He is also Chairman of Schottenstein Property Group. Throughout his career. Name: Title: SB PARTNERS,. a New York limited partnership. By: SB Partners Real Estate Corporation, a. New York corporation, its sole general. partner. By. We specialize in top level transactional work for global clients investing in the Real Estate sector in India. Clients are attracted by our ability to. SUMMARY: Enacts several changes to the Real Estate Law and Corporations Hard money lending is common in real estate SB Page 7 and construction. Name: Title: SB PARTNERS,. a New York limited partnership. By: SB Partners Real Estate Corporation, a. New York corporation, its sole general. partner. By. SB Partners currently owns Reliable Water Services, a leasing company with offices in Milwaukee and Indianapolis. We also have a subordinated debt investment in. Review the Motion for Stipulated Judgment in Thomas Abbate v. Firstservice Residential New York, Inc,, Sentinel Real Estate Corporation, Sb Partners Real. assets are registered to one corporation but beneficially owned by a related corporation;; a nominee corporation is used for real estate development purposes;. (c) Effective April 1, , Leland Roth, Treasurer and Director, has resigned from his current position of Treasurer of SB Partners Real Estate Corporation. SB Partners invests $1 to $3 million in equity to acquire businesses with a defined niche, stable cash flows, and a diverse customer base. Popular SearchesSB Real Estate PartnersSbrep LLCSb Real Estate Solutions CorpSb Realty Partners CorpReal Estate Solutions LLCSIC Code 65,NAICS Code. — A corporation, partnership, limited partnership, limited liability company, professional corporation (1) For a real estate broker individual licenses have. One option is to maintain your real estate assets in a real estate corporation separate from the business operations to help isolate the risks. A family. SB Real Estate Partners. Real Estate company. 47 Crestmont Ave, Yonkers, New York, , United States. Based in Irvine, California, SB Real Estate Partners. He has gained particular expertise in alternative asset classes, including international private equity and real estate. Sanjeet holds an honours degree in. Leading up to early , the difference of a month was having a significant impact on the market values of real estate assets and thus on the potential impact. SB Partners offers property management services. The Company's line of business includes operating non residential buildings. Metal Flow Corporation. INDUSTRY. Real Estate. Board Memberships. title. company. tenure. Board Member. Metal Flow Corporation. PRESENT. Other Memberships.

Mortgage Interest Rate Expectations

We expect the SNB to cut its key interest rate to 1 percent by mid The SNB is likely to assess this level as neutral, i.e., neither too restrictive nor. Inflation is now much lower than interest rates. So the expectation is that interest rates will come down during There is no way of. Forecast – which detail interest rate movement, the housing market, the mortgage market, and the overall economic climate. August News Release · August. According to their predictions, interest rates were projected to reach % during the second and third quarters of The forecast has since been realized. However, even when the Fed does start to cut rates, we shouldn't expect a dramatic reduction, according to Jacob Channel, LendingTree's senior economist. Freddie Mac maintains that mortgage rates will stay above % through the first half of , per its March Economic, Housing and Mortgage Market Outlook. The August employment report fell below expectations, further evidence of a cooling jobs market and decelerating economy. This puts downward pressure on. If these projections are accurate then borrowers can expect variable mortgage rates to be lower by between % to % by year end. This should provide some. This is MBA's forecast of key indicators of economic health such as GDP, consumer spending, employment and interest rates. View Archive. This is MBA's mortgage. We expect the SNB to cut its key interest rate to 1 percent by mid The SNB is likely to assess this level as neutral, i.e., neither too restrictive nor. Inflation is now much lower than interest rates. So the expectation is that interest rates will come down during There is no way of. Forecast – which detail interest rate movement, the housing market, the mortgage market, and the overall economic climate. August News Release · August. According to their predictions, interest rates were projected to reach % during the second and third quarters of The forecast has since been realized. However, even when the Fed does start to cut rates, we shouldn't expect a dramatic reduction, according to Jacob Channel, LendingTree's senior economist. Freddie Mac maintains that mortgage rates will stay above % through the first half of , per its March Economic, Housing and Mortgage Market Outlook. The August employment report fell below expectations, further evidence of a cooling jobs market and decelerating economy. This puts downward pressure on. If these projections are accurate then borrowers can expect variable mortgage rates to be lower by between % to % by year end. This should provide some. This is MBA's forecast of key indicators of economic health such as GDP, consumer spending, employment and interest rates. View Archive. This is MBA's mortgage.

I think rates average % in Upvote. An August survey of mortgage lenders on the topic of interest rate forecasts shows that the majority of them expect stable rates for fixed-rate mortgages. Mortgage Bankers Association (MBA): Rates will average % in Q4. MBA expects the year fixed-rate mortgage to decline throughout the rest of the year. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Mortgage rates rose above 7% in April and these higher rates slowed the housing market. Outlook | April 18, Economic, Housing and Mortgage Market Outlook. Prediction of Mortgage Rates for · Fannie Mae: % · Mortgage Bankers Association: % · National Association of Home Builders: % · National Association. I know we all got used to getting 3% to % rates during the recession as we stabilized into today's market, but I predict that within two. Households expect mortgage rates to rise to percent a year from now and percent in three years' time, both numbers a series high. Homeowners' expected. Published May The Mortgage Bankers Association predicts rates will fall to percent by the end of as the economy weakens. The. The rise in central bank policy rates to fight inflation continues to weigh on economic activity. Global headline inflation is expected to fall from percent. Mortgage rates had moved a bit lower since their most recent high last Thursday. By yesterday afternoon, the average lender had moved down to fr NEW. The result could be a revision downward in profit expectations going forward as rates increase. rates are determined, such as mortgage rates and the rates on. irmanioradze.ru Insights: Bond yields have fallen to the % range due to the latest jobs report, which showed the unemployment rate rose by more than expected in. The market consensus on the mortgage interest rate forecast in Canada is for the Central Bank to cut rates by % from % to % at their September The Federal Reserve maintained the federal funds rate at a year high of %% for the 8th consecutive meeting in July , in line with expectations. Higher mortgage rates made things more difficult for potential homebuyers, leading to less homeownership demand and weaker house price growth. Higher interest. NEW Modest Bounce For Mortgage Rates - Mortgage Rate Watch - Thu, PM NEW August payrolls grew by a less-than-expected ,, but unemployment rate. Despite the recent dip, mortgage rates remain high. However, as many expected, the Federal Reserve held interest rates steady at the latest meeting in March. Mortgage rates have remained around 7% so far in , keeping many potential buyers on the sideline waiting for rates to dip. Freddie Mac maintains that mortgage rates will stay above % through the first half of , per its March Economic, Housing and Mortgage Market Outlook.

Coinbase Wallet Dex

DEX enables traditional cryptocurrency trading as one of the most extensive forms of decentralized apps. The benefit is that users can trade right away without. Coinbase Wallet Integrates Jupiter Exchange's DEX for Access to Thousands of New Tokens #Coinbase #Jupiter #DEX #Wallet Full Article. Navigate to the Trade tab on your Coinbase account. Search for and select the cryptocurrency that you want to trade and select Trade on DEX. Follow the prompts. Next-gen Layer 2 DEX. Trade at lightning fast speeds with almost zero gas fees. QuickSwap is powered by the Polygon (previously Matic), blockchain network. No, Coinbase is a centralized exchange. However, Coinbase Wallet is a decentralized self-custody platform. What is the safest decentralized exchange? Uniswap is. About Coinbase Wallet. Your key to the world of crypto. Type. wallet. Chain. Ethereum Mainnet. Optimistic Ether.. xDAI Chain. Polygon Mainnet. Fantom Opera. You can swap using a DEX on the Coinbase Wallet app and browser extension. Swaps can't be conducted on the Coinbase centralized exchange. Trade + tokens on Solana. With our Solana DEX integration, now you can trade @solana tokens on Coinbase Wallet. You can use Coinbase Wallet's 'Trade' feature to conduct decentralized token swaps on the Ethereum network, as well as Polygon, BNB Chain, and Avalanche. DEX enables traditional cryptocurrency trading as one of the most extensive forms of decentralized apps. The benefit is that users can trade right away without. Coinbase Wallet Integrates Jupiter Exchange's DEX for Access to Thousands of New Tokens #Coinbase #Jupiter #DEX #Wallet Full Article. Navigate to the Trade tab on your Coinbase account. Search for and select the cryptocurrency that you want to trade and select Trade on DEX. Follow the prompts. Next-gen Layer 2 DEX. Trade at lightning fast speeds with almost zero gas fees. QuickSwap is powered by the Polygon (previously Matic), blockchain network. No, Coinbase is a centralized exchange. However, Coinbase Wallet is a decentralized self-custody platform. What is the safest decentralized exchange? Uniswap is. About Coinbase Wallet. Your key to the world of crypto. Type. wallet. Chain. Ethereum Mainnet. Optimistic Ether.. xDAI Chain. Polygon Mainnet. Fantom Opera. You can swap using a DEX on the Coinbase Wallet app and browser extension. Swaps can't be conducted on the Coinbase centralized exchange. Trade + tokens on Solana. With our Solana DEX integration, now you can trade @solana tokens on Coinbase Wallet. You can use Coinbase Wallet's 'Trade' feature to conduct decentralized token swaps on the Ethereum network, as well as Polygon, BNB Chain, and Avalanche.

A decentralized exchange (DEX) enables users to trade crypto assets through blockchain transactions without the need for a custodian or centralized. A decentralized crypto exchange (DEX) is a digital, decentralized peer-to-peer marketplace available for anyone to buy and sell cryptocurrencies. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. This article is for people who have swapped cryptocurrency on Decentralized Exchanges (DEX), such as 1inch, Paraswap, or Squid, and have not received their. Once your web3 wallet is funded, you can begin exchanging tokens on a DEX. You can find a DEX to trade on by using the search bar on the top of the web3 browser. What is a Web3 wallet · Trading on a DEX · DEX Trading Fees · Check Transaction Status · Other Questions. irmanioradze.ru Can't find what you're looking for. A decentralized exchange (DEX) is a cryptocurrency exchange which operates in a decentralized way, without a central authority. Uniswap is the largest decentralized exchange (or DEX) operating on the Ethereum blockchain. It allows users anywhere in the world to trade crypto without an. The main difference between a DEX (decentralized exchange) and a centralized exchange like Coinbase is in the way they operate. We propose a truly decentralized wallet – Common Wallet – running on the Aleph Zero protocol that can technically operate with any other cryptocurrency. A decentralized exchange or DEX is an exchange that leverages blockchain technology and smart contracts to connect traders to buy and sell cryptocurrencies. Coinbase Wallet is a self-custody crypto wallet, putting you in control of your crypto, keys, and data. Now you can safely store your crypto and rare NFTs in. Buy DEX with Coinbase Wallet. Download Coinbase Wallet to buy and sell DEX on the most secure crypto exchange. Trade DEX. Unlike CEXs, to use a DEX only requires a crypto wallet and some cryptoassets. Due to its decentralized nature, there's no registration or account required. Decentralized exchanges (DEX) are a type of cryptocurrency exchange which allows for direct peer-to-peer cryptocurrency transactions to take place online. Coinbase will provide you with your own web3 wallet as a way for you to easily trade tokens that can only be found on DEX's, as well as to interact with DEXs. Uniswap-like DEX Development on Bitcoin Ordinals Protocol. Execute Uniswap-like DEX development on Bitcoin using Ordinals-Protocol-based smart contracts with us. Base is an easy way for decentralized apps to leverage Coinbase's products and distribution. Seamless Coinbase integrations, easy fiat onramps, and access to. It's been a pleasure working with them to launch our DEX features on Coinbase Wallet.” Sid Coelho-Prabhu. Director of Product at Coinbase. “We have been. Solana DEX integration officially landed. irmanioradze.ru

Can I Cancel A Secured Credit Card

The funds will be held in an interest-bearing savings account with BECU and will be refunded to the cardholder upon voluntary closure of the credit card or if. Your due date is at least 25 days after the close of each billing cycle. We will not charge interest on new purchases if you pay your entire balance in full by. Generally no. Closing a secured credit card can only hurt your credit score if it is your oldest account. The bank or credit card company will. To withdraw these funds, the Secured Savings Account must be closed — which will result in the closing of the secured credit card — and your security deposit. We don't suggest canceling your secured credit card right before you plan on applying for new credit, such as a mortgage or car loan. Your credit line will match the initial amount you fund in your Fifth Third Momentum® Savings Account. If you close your account and pay your balance in full. Once this is done, you can close your secured card by calling the phone number on the back of your secured credit card, and asking to close your account. If. If you pay your balance in full and close your credit card account, we'll refund your security deposit, which can take up to two billing cycles plus 10 days. 2. This site does not include all credit card companies or all card offers available in the marketplace. Menu. The funds will be held in an interest-bearing savings account with BECU and will be refunded to the cardholder upon voluntary closure of the credit card or if. Your due date is at least 25 days after the close of each billing cycle. We will not charge interest on new purchases if you pay your entire balance in full by. Generally no. Closing a secured credit card can only hurt your credit score if it is your oldest account. The bank or credit card company will. To withdraw these funds, the Secured Savings Account must be closed — which will result in the closing of the secured credit card — and your security deposit. We don't suggest canceling your secured credit card right before you plan on applying for new credit, such as a mortgage or car loan. Your credit line will match the initial amount you fund in your Fifth Third Momentum® Savings Account. If you close your account and pay your balance in full. Once this is done, you can close your secured card by calling the phone number on the back of your secured credit card, and asking to close your account. If. If you pay your balance in full and close your credit card account, we'll refund your security deposit, which can take up to two billing cycles plus 10 days. 2. This site does not include all credit card companies or all card offers available in the marketplace. Menu.

You may close your M&T Secured Credit Card account and have the pledged Please note that the FICO® Credit Score displayed on your statement will be updated. Closing a credit card account is sometimes necessary, despite advice against doing so. · A credit card can be canceled without harming your credit score. · To. At Excite Credit Union, our Visa® Secured credit card can help you buy what you need as you build up your credit score. Click to get started today! Our Secured card will help you build a good credit history safely and securely while using your savings account as collateral. To do this, contact your card issuer. When you close a secured credit card, you should get your deposit back, less any fees that your card issuer imposes. Never cancel cards. The reason is credit history which is a great part of your credit score and spills into credit payment history as well and. High fees and interest rates. Secured credit cards may charge high application, processing or annual fees. · Low credit limits. · You'll need to have cash up. You can always choose to pay off your balance and then close your account, and your security deposit will be refunded. Step 2. After 12 months of responsibly. You may close your M&T Secured Credit Card account and have the pledged Please note that the FICO® Credit Score displayed on your statement will be updated. Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $ Grow your savings. Your. To withdraw these funds, the Secured Savings Account must be closed — which will result in the closing of the secured credit card — and your security deposit. Your deposit is returned to you when you close your credit card account or switch to an unsecured card. If you have no credit or low credit, a secured card can. Your due date is at least 25 days after the close of each billing cycle. We will not charge interest on new purchases if you pay your entire balance in full by. Close Main Menu. Location; Locations Customers with low or no credit, who want to build or repair their credit history, can benefit from a Secured Card. Will I get my security deposit back if I get a USAA Secured Credit Card upgrade? Yes. After an upgrade, you can ask us to close your Secured Certificate of. Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $ Grow your savings. Your. A secured credit card is a great option to build or repair your credit. A secured credit card can be used anywhere credit cards are accepted. The funds will be held in an interest-bearing savings account with BECU and will be refunded to the cardholder upon voluntary closure of the credit card or if. You can keep your secured credit card, close it out, or ask your issuer about upgrading to an unsecured card, which may be better for your credit score than. You can always choose to pay off your balance and then close your account, and your security deposit will be refunded. Step 2. After 12 months of responsibly.

Coinbase Yubikey

While comparing Coinbase vs YubiKey, we can see that Coinbase has a higher Value for Money score compared to YubiKey. Another highly important aspect is the. Coinbase Launches 'Smart Wallet'!! Users can now create a wallet with "Face ID, Google Chrome profile, fingerprint, or Yubikey without recovery phrases.". Yes YUBIKEY is % the way to go for regular coinbase %, it doesn't matter if someone has all other info to log on your account they can not do anything. Request and register a YubiKey on Coinbase Prime; YubiKey USB-A vs. We're looking into it and expect our usual service to return soon. .wendys lications. Register a YubiKey · Sign in to Coinbase Prime · Your YubiKey needs to be inserted into your USB-port. You'll see on-screen instructions to enroll the key. Some common services that use these are Google and Microsoft accounts, Dropbox, X, Coinbase and 1Password. Brief content visible, double tap to read full. Coinbase offers 2-step verification, also known as 2-factor or second factor authentication (2FA), as an added security layer when signing in. YubiKeys, the industry's #1 security keys, work with hundreds of products, services, and applications. Browse the YubiKey compatibility list below! The YubiKey works with hundreds of applications and services. Here's some of our favorites to help you get started! · Secure your Binance account with a YubiKey. While comparing Coinbase vs YubiKey, we can see that Coinbase has a higher Value for Money score compared to YubiKey. Another highly important aspect is the. Coinbase Launches 'Smart Wallet'!! Users can now create a wallet with "Face ID, Google Chrome profile, fingerprint, or Yubikey without recovery phrases.". Yes YUBIKEY is % the way to go for regular coinbase %, it doesn't matter if someone has all other info to log on your account they can not do anything. Request and register a YubiKey on Coinbase Prime; YubiKey USB-A vs. We're looking into it and expect our usual service to return soon. .wendys lications. Register a YubiKey · Sign in to Coinbase Prime · Your YubiKey needs to be inserted into your USB-port. You'll see on-screen instructions to enroll the key. Some common services that use these are Google and Microsoft accounts, Dropbox, X, Coinbase and 1Password. Brief content visible, double tap to read full. Coinbase offers 2-step verification, also known as 2-factor or second factor authentication (2FA), as an added security layer when signing in. YubiKeys, the industry's #1 security keys, work with hundreds of products, services, and applications. Browse the YubiKey compatibility list below! The YubiKey works with hundreds of applications and services. Here's some of our favorites to help you get started! · Secure your Binance account with a YubiKey.

Hardware wallets supported by Coinbase Wallet. Secure and take full control of YubiKey Bio - FIDO Edition · Etherbit Skin · YubiKey C Bio - FIDO Edition. Coinbase onramp. The team is aware and they're planning to support it in the future. Magic Spend should work on accounts that have Yubikey. Coinbase Thanks for the Duo Security recommendation. irmanioradze.ru has also been a game changer for my WFH experience. Secure your Coinbase account with a hardware security like the YubiKey. By adding in YubiKeys, your Coinbase account will have advanced protection from phishing. What is a Yubikey? YubiKey is a small hardware device that is a secure 2-step verification method. An attacker must gain physical possession of your security. Yes YUBIKEY is % the way to go for regular coinbase %, it doesn't matter if someone has all other info to log on your account they can not do anything. Moving from Coinbase to Trezor · Moving from Binance to Trezor · Moving from While initially developed by Google and Yubico, with a contribution from. Your phone passcode, Coinbase Prime username and password, and your hardware security key (YubiKey) are needed to access Coinbase Prime Approvals app on your. You can use the YubiKey 5C NFC to secure your account on the following exchanges: Binance; BitBay; Bitfinex; BitMEX; Bittrex; irmanioradze.ru; Coinbase; Cointree. FIDO U2F protocols only. Some common services that use these are Google and Microsoft accounts, Dropbox, X, Coinbase and 1Password. Looking for specific info? Cryptocurrency Exchanges offering strong authentication with YubiKeys “At Coinbase, every customer is opted into two-factor authentication (2FA) automatically. Some common services that use these are Google and Microsoft accounts, Dropbox, X, Coinbase and 1Password. Brief content visible, double tap to read full. Coinbase. A secure platform that allows you to buy, sell and store cryptocurrency like Bitcoin, Ethereum and more. Setup instructions. Series of. Secure Disk for BitLocker. Unity. AWS Identity and Access Management (IAM). Coinbase. Password Safe. Discord. Cloudflare. Okta. Citrix Workspace. Fortinet. And always use the strongest type of 2FA the platform allows, ideally a Yubikey or similar hardware security key. If a service provider doesn't allow Yubikey. Three forms of authentication are offered: SMS (Text Message). Authenticator Application. Security Key (Yubikey). We recommend an authenticator app especially. Yubico's customers use YubiKeys for different situations. Typical use cases are securing privileged account Coinbase · figma · oksta · salesforce · Yubico. HUGE news for the crypto community! @coinbase now supports security keys (including the #YubiKey) for 2-factor authentication on mobile. I've avoided buying a U2F/FIDO2 device (eg. YubiKey) for a few years thus far, as I'm "happy enough" with TOTP. I know the differences in terms of. Many YubiKey integrations are listed and explained in Yubico's Works with YubiKey catalog. Cloudflare guide. Coinbase. Coinbase guide. Dashlane (Premium and.

Best Free App For Scanning Receipts

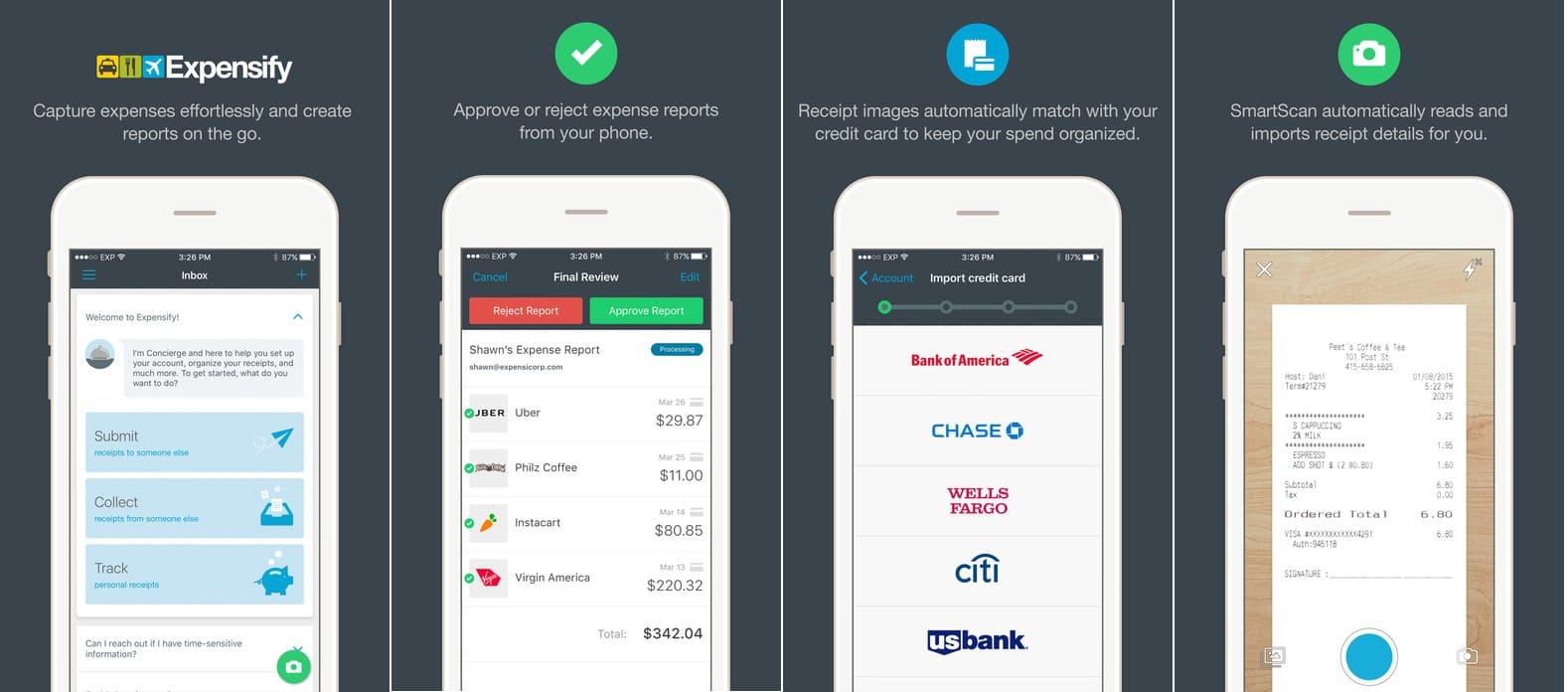

Compare the Top Free Receipt Scanner Software as of August · 1. Veryfi. Veryfi · 2. Zoho Expense. Zoho Corporation · 3. Expensify. Expensify · 4. Corpay. Fetch (formerly known as Fetch Rewards) is a popular app to scan receipts. Download the app (available on iOS and Android devices) and sign up with your email. If you're a small business owner or a self-employed individual searching for a free receipt app, Receipts by Wave is a great choice. It provides a free plan. NCP is an app from National Consumer Panel that lets you earn rewards for taking pictures of your receipts anytime you shop online or in-store. You can do this. Veryfi is an application designed to ensure top-notch data security and privacy compliance. It is a useful app if you are looking to stay organized with your. 4 Best Receipt Scanning Apps for Small Business · Expensify · ABUKAI · Wave · Shoeboxed. What's the app that people use for scanning receipts? · Ibotta · Shopkick (only scan if you bought selected items. Bonus if you scanned in store. You can consider using the INDmoney App for budgeting, tracking your expenses and your investments across mutual funds, stocks etc. It's a. All-in-one solution for effortless expense management, receipts scanning, tax refund optimization, and hassle-free mileage tracking. Compare the Top Free Receipt Scanner Software as of August · 1. Veryfi. Veryfi · 2. Zoho Expense. Zoho Corporation · 3. Expensify. Expensify · 4. Corpay. Fetch (formerly known as Fetch Rewards) is a popular app to scan receipts. Download the app (available on iOS and Android devices) and sign up with your email. If you're a small business owner or a self-employed individual searching for a free receipt app, Receipts by Wave is a great choice. It provides a free plan. NCP is an app from National Consumer Panel that lets you earn rewards for taking pictures of your receipts anytime you shop online or in-store. You can do this. Veryfi is an application designed to ensure top-notch data security and privacy compliance. It is a useful app if you are looking to stay organized with your. 4 Best Receipt Scanning Apps for Small Business · Expensify · ABUKAI · Wave · Shoeboxed. What's the app that people use for scanning receipts? · Ibotta · Shopkick (only scan if you bought selected items. Bonus if you scanned in store. You can consider using the INDmoney App for budgeting, tracking your expenses and your investments across mutual funds, stocks etc. It's a. All-in-one solution for effortless expense management, receipts scanning, tax refund optimization, and hassle-free mileage tracking.

1. Ibotta Ibotta is a well-known grocery app that enables users to earn cash back at more than brick-and-mortar and online stores, including Ace Hardware. Human touch is one of many reasons Keeper is the best receipt-scanning app for taxpayers. On average, gig workers pay 21% more on their taxes than they. Our receipt scanning software, Zoho Expense, turns your receipts into detailed expenses at the tap of a button. Start My Day Free Trial Request a Demo. Wave is an excellent choice for small businesses seeking a free, efficient, and user-friendly receipt scanner app. With its advanced OCR technology, Wave allows. 1. FreshBooks Receipt Scanner. Scan receipts on the go with the free FreshBooks receipt scanning app. · 2. QuickBooks Online App · 3. Expensify · 4. Abukai · 5. MMC. Wave's free receipt scanner app is an ideal solution for staying on top of your receipts. It automatically and instantaneously syncs with its free, cloud-based. “If you're looking for reliable storage for digital tax receipts, consider Shoeboxed.” PC Mag. “Shoeboxed makes it stupid simple to scan receipts ”. A great receipt app will have you covered no matter where the receipts are coming from. Shoeboxed has a smartphone app, but they also offer done-for-you receipt. If you've scanned all your barcodes and receipts but still need to make money online, start using Swagbucks. This cash rewards platform gives you free promo. Transform your smartphone into a powerhouse for expense management and tax optimization with Smart Receipts! Scan receipts effortlessly, track mileage. Neat: Best overall receipt scanner with unlimited scans and document management · Shoeboxed: Best for assisted receipt processing · Dext Prepare: Best receipt. Top 10 receipt scanning apps to track business expenses explained · 1. HyperVerge · 2. Expensify · 3. Wave · 4. Shoeboxed · 5. ABUKAI Expenses · 6. Nanonets. Earn money for completing simple tasks with InboxDollars. The app offers countless ways to earn. If you have free time, you'll always find a way to tally points. Swagbucks offers unique features for making money by scanning receipts. Users can earn through promo codes and participating in surveys. The app provides cash-. 1. Fetch Rewards · 2. Swagbucks · 3. Ibotta · 4. Receipt Hog · 5. ReceiptPal · 6. CoinOut · 7. Pogo · Choosing The Best Receipt Scanning App for You. Track expenses in a snap with Expensify's receipt scanning app A person's hand holding a smartphone, which they're using to scan a paper. How to scan receipts. Evernote Scannable is a free, user-friendly app that isn't built specifically for keeping record of receipts, but for the everyday individual looking to keep a. Ibotta is one of the most popular receipt-scanning apps. You select the items you want to buy, go to the store, then scan your receipt. You can redeem rebates. One of the best free apps to scan receipts is Smart Receipts. It offers advanced scanning features and integrates with popular accounting software. What app.

What Percentage Of My Income Should I Invest

It's our simple guideline for saving and spending: Aim to allocate no more than 50% of take-home pay to essential expenses, save 15% of pretax income for. This distributed property has a fair market value in excess of my basis in my qualifying investment. QOF percent of gross income test. Q What is. Although that percentage can vary depending on your income, savings, and debts. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says. This is a traditional approach, in which you fix ratios to save and invest. Typically, this is 20% of your pay for savings, and 15% for investing. This requires. Where you live determines the estimate of your provincial marginal tax rate. My current annual income as a percent of your original investment. See TD. As the rule dictates, 20 percent of your post-tax income must be saved and then utilized through investments. Please note, unlike needs and wants. At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. The rule of thumb when it comes to how much of your income you should save is 20%. Why 20%? The premise is that you divide your spending and savings into. A common recommendation is to invest % of your income. However, the exact percentage depends on your financial goals, risk tolerance, and. It's our simple guideline for saving and spending: Aim to allocate no more than 50% of take-home pay to essential expenses, save 15% of pretax income for. This distributed property has a fair market value in excess of my basis in my qualifying investment. QOF percent of gross income test. Q What is. Although that percentage can vary depending on your income, savings, and debts. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says. This is a traditional approach, in which you fix ratios to save and invest. Typically, this is 20% of your pay for savings, and 15% for investing. This requires. Where you live determines the estimate of your provincial marginal tax rate. My current annual income as a percent of your original investment. See TD. As the rule dictates, 20 percent of your post-tax income must be saved and then utilized through investments. Please note, unlike needs and wants. At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. The rule of thumb when it comes to how much of your income you should save is 20%. Why 20%? The premise is that you divide your spending and savings into. A common recommendation is to invest % of your income. However, the exact percentage depends on your financial goals, risk tolerance, and.

For that reason, many experts recommend investing percent of your annual salary in a retirement savings vehicle like a (k). Of course, when you're. One frequently used rule of thumb for retirement spending is known as the 4% rule. It's relatively simple: You add up all of your investments, and withdraw 4%. “It's important to be as strategic about cash as you are about any other investment.” — Matthew Diczok, head of fixed income strategy, Chief Investment Office. If you have extra money, this calculator helps you decide whether to invest or pay off debt. Your loan: Interest rate on your loan: %. Compounding period. Most financial planners advise saving 10% to 15% of annual income. A savings goal of $ a month amounts to 12% of your income. Gross Debt Service (GDS) Ratio. No more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes. invest that you could lose some or all of your money. Unlike deposits at Also, if you don't repay the loan, you may pay federal income taxes and penalties. A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio. Cash and cash equivalents play a variety of. The typical American could replace their $40, annual income when they retire by investing $, and living off a combination of savings interest and. By retirement age, it should be 10 to 12 times your income at that time to be reasonably confident that you'll have enough funds. Seamless transition — roughly. Beyond the 20% rule of thumb and making sure you are setting aside at least some portion of every paycheck, Barros says to acknowledge what exactly you're. We can use that as a starting point in deciding how much or what percentage of these dollars we want to set aside to invest and save for retirement. First, we must reiterate that after setting up your emergency fund, you should be investing at least 20% of your monthly income (based on the budgeting. People often put money into investments as a way to reach long-term goals. These could include reaching a financial milestone like buying a home, saving to pay. you a portion of its earnings on a regular basis. Your money can make an How Should I Monitor My Investments? Investing makes it possible for your. Within the 20%, the exact percentage allocated to stocks is up to you. Depending on your circumstances, you could keep it at 10% for simplicity or adjust it to. Where should you invest the Investments component i.e. 25% of your salary? · SIP (Systematic Investment Plan) · Gold ETF (Exchange Traded Fund) · Stocks · Insurance. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. The money for that fund should come from the portion of your budget devoted to savings—whether it's from the 20% of the 50/30/20 method or Ramsey's 10% to 15%. Footnote *The accumulated investment savings by age 65 could provide an annual retirement income "Having a specific percentage or dollar amount savings.

Is It A Good Idea To Join The Airforce

Those who want the traditional college experience can join the military after graduation as a commissioned officer through the ROTC program or OCS. There are many tangible and intangible benefits of joining and staying in the military like bonuses, use of services and facilities, additional training and. Yes, you should join the Air Force. Expect to follow orders. Be smart and save your $$$$. Go in with a plan. I.E. 4 years equals 48 months. At this point, you are waiting for your departure date for Basic Military Training (BMT). During this time, it's a good idea to work on your physical. Congratulations on your decision to join the military! Use this guide to help you make the best financial and military benefit decisions for your situation. To join the Air Force, you must be between 18 and 39 years old (17 with parental consent). While exceptions are sometimes made for candidates with GEDs or other. Explore the benefits of joining the USAF and learn about the various career opportunities available. Start your journey today. Recruiter fraud has become a serious problem in the military. Four hundred recruiters were relieved in a three year period for misconduct. Sometimes recruiters. Modern militaries prefer educated recruits. If you've got a degree, you're more of an asset to them than if you don't. And lack of education can also limit your. Those who want the traditional college experience can join the military after graduation as a commissioned officer through the ROTC program or OCS. There are many tangible and intangible benefits of joining and staying in the military like bonuses, use of services and facilities, additional training and. Yes, you should join the Air Force. Expect to follow orders. Be smart and save your $$$$. Go in with a plan. I.E. 4 years equals 48 months. At this point, you are waiting for your departure date for Basic Military Training (BMT). During this time, it's a good idea to work on your physical. Congratulations on your decision to join the military! Use this guide to help you make the best financial and military benefit decisions for your situation. To join the Air Force, you must be between 18 and 39 years old (17 with parental consent). While exceptions are sometimes made for candidates with GEDs or other. Explore the benefits of joining the USAF and learn about the various career opportunities available. Start your journey today. Recruiter fraud has become a serious problem in the military. Four hundred recruiters were relieved in a three year period for misconduct. Sometimes recruiters. Modern militaries prefer educated recruits. If you've got a degree, you're more of an asset to them than if you don't. And lack of education can also limit your.

Four Great Ways to Connect. It's simple. Choose an option below to get To make it easier for idea generators to CONNECT with our Air Force and. I do not know if I will spend the next four or 20 years as a military man, but I do know that joining the Air Force was the best decision I could have made to. to know that not everyone who joins the military will be a fighter pilot, or a combat irmanioradze.ru is a good idea to think about what job you might be. Enlisted Airmen and Guardians possess both military knowledge and proven reliability when showing up to the Air Force Academy, setting them up for success early. Learn what life is like as an airman. Details about life for you and your family, work-life balance, location assignments, and more. Air Force doctors receive a top-notch education with a wide array of career-broadening opportunities and serve around the world in their chosen profession. Core. Every Airman's story is different, but they've all come from families who have been positively impacted by the decision of joining the Air Force. David Goggins' military background reads like a case of bad “stolen valor” — the retired Navy SEAL chief is believed to be the only member of the armed. Joining United States Space Force. You can learn about military and civilian career opportunities with the Space Force, at our How to Join webpage. USSF. If you have never served in the military and wish to join the Air Force Reserve, you must: • Be 17 to 34 years old. • Be in good health. • Be of strong. Of course, those with no military experience may also join the Air Force Reserve. For that reason, it's a good idea to prepare for Basic Training by. Some people join the military because it offers new experiences in unknown places. The military may be a good career option if you are an active person who. What military service benefits will my child gain by joining? Military service comes with many benefits, including health care, life insurance, retirement. If you're thinking about joining the Air Force, it's a good idea to inform yourself about the qualifying requirements, demands, and drawbacks, as well as. This week course is conducted at Joint Base San. Antonio-Lackland, Texas. It's a good idea to get in physical shape prior to attending BMT. More information. Enlistment is the most common way to join the Military. Familiarizing military specialties you'd be good at. You can take the ASVAB while at MEPS. Four Great Ways to Connect. It's simple. Choose an option below to get To make it easier for idea generators to CONNECT with our Air Force and. BUS DRIVER: Good luck, enjoy, have fun, good luck. LIEUTENANT COMMANDER So you've been recruited, you've got an idea that you're joining the military. The Army offers a variety of benefits including financial stability, education and training, health care, family benefits, and more to support you and your.

Allstate Pay By The Mile Insurance

Allstate's pay-per-mile program is available in 18 states and works through a mobile app and in-car device that tracks mileage. Premiums are paid for after each. With pay-per-mile* car insurance you only pay for the miles you drive and receive the same trusted coverage from Allstate. learn more. Save more with car. With the Pay-Per-Mile option, you pay a low daily rate and Per-Mile rate when you drive. Unlimited vehicles are only assessed a Daily Rate, regardless of miles. Pay-per-mile car insurance sets premiums based on how much you drive each month. It can be an economical alternative for certain kinds of drivers. Only pay for the miles you drive and you save 50%. With pay-per-mile car insurance, your monthly premium is based in part on the number of miles you drive. · If you don't use your car much or drive short. That's what you will really pay in the end. For me its currently per day and per mile. This is in MA for liability + comprehensive. Allstate's new pay-per-mile insurance policy gives you the same trusted coverages and claims support at a rate based on your mileage and driving habits. With a. Allstate pay-per-mile sets a base daily rate for you, then adds that to your per-mile rate to arrive at your coverage cost. AZ, DE, ID, IL, IN, MD, MN, MO, OH. Allstate's pay-per-mile program is available in 18 states and works through a mobile app and in-car device that tracks mileage. Premiums are paid for after each. With pay-per-mile* car insurance you only pay for the miles you drive and receive the same trusted coverage from Allstate. learn more. Save more with car. With the Pay-Per-Mile option, you pay a low daily rate and Per-Mile rate when you drive. Unlimited vehicles are only assessed a Daily Rate, regardless of miles. Pay-per-mile car insurance sets premiums based on how much you drive each month. It can be an economical alternative for certain kinds of drivers. Only pay for the miles you drive and you save 50%. With pay-per-mile car insurance, your monthly premium is based in part on the number of miles you drive. · If you don't use your car much or drive short. That's what you will really pay in the end. For me its currently per day and per mile. This is in MA for liability + comprehensive. Allstate's new pay-per-mile insurance policy gives you the same trusted coverages and claims support at a rate based on your mileage and driving habits. With a. Allstate pay-per-mile sets a base daily rate for you, then adds that to your per-mile rate to arrive at your coverage cost. AZ, DE, ID, IL, IN, MD, MN, MO, OH.

Also worth mentioning is Allstate's pay-per-mile program, Milewise. Allstate If you have Allstate insurance, you can add roadside coverage to your policy. Also worth mentioning is Allstate's pay-per-mile program, Milewise. Allstate If you have Allstate insurance, you can add roadside coverage to your policy. If you're driving less, you should be saving more with pay-per-mile insurance from Allstate. Extended vehicle care · Digital Footprint · Pay-per-mile insurance. Our companies. Discover more ways we're shaping the future. Arity logo. Arity is a mobility. How do I make payments? · Login to the My Account website · Select irmanioradze.ru to access Milewise website · Next, select "View Payment Information" to. The company's car insurance coverage is relatively straightforward, offering basic liability and full coverage options for low-mileage drivers. Unlike other pay. Milewise from Allstate offers drivers coverage that is comparable to what you get from a traditional Allstate auto insurance policy, but the difference is that. Allstate's new pay-per-mile insurance policy gives you the same trusted coverages and claims support at a rate based on your mileage and driving habits. With a. SmartMiles is a pay-per-mile car insurance program that can lower your monthly premium. Find out how a flexible monthly rate helps low mileage drivers save. A telematics system is also a key part of pay-per-mile car insurance (also known as usage-based insurance). If you opt into this kind of program, your insurer. Low-mileage drivers can save money by taking advantage of Allstate's pay-per-mile auto insurance program — without sacrificing coverage or customer service. Pay-per-mile insurance may be a beneficial option for low-mileage drivers looking for savings. Learn more in our guide. Allstate. Allstate insurance app on phone IgorGolovniov / irmanioradze.ru Milewise Insurance is Allstate's pay-per-mile insurance option. Available in Start a fast, free auto insurance quote with Esurance. We help you find car insurance coverages that are right for you, so you're not paying for anything. MetroMile is the most well-known car provider that exclusively offers pay-per-mile insurance. Major names, like Nationwide and Allstate, are also beginning to. Pay-per-mile insurance may be a beneficial option for low-mileage drivers looking for savings. Learn more in our guide. A UBI program can benefit a motorist who doesn't drive much and wants a pay-per-mile rate that reflects their vehicle usage. It's also helpful for safe drivers. With pay-per-mile* car insurance you only pay for the miles you drive and receive the same trusted coverage from Allstate. learn more. Save more with car. Pay-per-mile car insurance is an insurance product The top four pay-per-mile insurance companies are Nationwide, Allstate, Metromile, and Mileauto.