irmanioradze.ru Community

Community

How To Get Paid Off Collections Off Credit Report

How to Get a Paid Debt Off Of Your Credit Report · Write a Goodwill Letter · Dispute the Collection · Ask the Collection Agency for Validation · Pay for Delete. If you have a single account that is charged-off or has already been sold to a third-party collector, you work out a settlement directly with that company. In. So you need to get the paid collection removed by disputing it or negotiating with the collector. However, the older the collection is, the less it will affect. collection agencies to remove negative information from your credit report have any negative information about the debt removed from your credit files. You have different options for removing collections from your credit report. You can dispute them, negotiate with the collectors, or wait for them to fall off. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. Option 2: Send a pay for delete letter A pay for delete letter is a way to negotiate with a collection agency to have negative information removed from your. 1) Write a goodwill letter requesting forgiveness and removal from the creditor or collector. 2) Create a valid dispute letter that challenges the collection if. You can request a "goodwill deletion" from the creditor, who may be the original creditor or a debt collector. Send a letter to the debt. How to Get a Paid Debt Off Of Your Credit Report · Write a Goodwill Letter · Dispute the Collection · Ask the Collection Agency for Validation · Pay for Delete. If you have a single account that is charged-off or has already been sold to a third-party collector, you work out a settlement directly with that company. In. So you need to get the paid collection removed by disputing it or negotiating with the collector. However, the older the collection is, the less it will affect. collection agencies to remove negative information from your credit report have any negative information about the debt removed from your credit files. You have different options for removing collections from your credit report. You can dispute them, negotiate with the collectors, or wait for them to fall off. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. Option 2: Send a pay for delete letter A pay for delete letter is a way to negotiate with a collection agency to have negative information removed from your. 1) Write a goodwill letter requesting forgiveness and removal from the creditor or collector. 2) Create a valid dispute letter that challenges the collection if. You can request a "goodwill deletion" from the creditor, who may be the original creditor or a debt collector. Send a letter to the debt.

Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. If you have paid off all of your debts, and none of your past negative information is reporting on your credit bureau, you will have no credit score (or a. You will have to call the collections agency directly, not your apartment, and ask for a "pay for delete". Ask that since the debt will be. How to get collections off your credit report · 1. Send a dispute · 2. Negotiate a pay-for-delete agreement · 3. Ask for a goodwill deletion. How to get collections off your credit report · 1. Send a dispute · 2. Negotiate a pay-for-delete agreement · 3. Ask for a goodwill deletion. when you paid your bills. • late or missed payments. • debts you did not pay that were written off or sent to a collection agency. • whether you have declared. In general, paying off a collection account doesn't remove it from your credit report. Per the FCRA, a paid collection account can remain on your credit. With the new scoring system by Fair Isaac and Company, paying off old debt does not hurt your credit score. It distinguishes between new payments and new. Your original creditor may be most willing to take your debt back if you have already worked out a plan with your debt collector and begun repaying what you owe. The only way to remove a paid collection from a credit report is to write a letter of goodwill deletion to the lender explaining your. Paying the past-due amount to the lender before it is sold may prevent a collections account from being reported on your credit reports (assuming the lender. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. 1) Write a goodwill letter requesting forgiveness and removal from the creditor or collector. 2) Create a valid dispute letter that challenges the collection if. Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt. According to most credit scoring models, paying off a collection account doesn't stop it from having an effect on your credit. You'll usually have to wait until. If the charged-off account belongs to you and all the information being reported about it is accurate, you could try negotiating with the creditor or debt. In general, paying off a collection account doesn't remove it from your credit report. Per the FCRA, a paid collection account can remain on your credit. With the counselor's help, call the collections agency and arrange a payment plan so the delinquent marks roll off your credit report as quickly as possible. If you're negotiating with a collection agency on payment of a debt, consider making your credit reports part of the negotiations. You can ask the collector.

Cash Out Refinance To Pay Off Student Loans

Homeowners who have mortgage payments, as well as student loans from either their own education or their children's education, have the option to cash out. A mortgage refinance is when you get a new mortgage loan for your home, typically with a lower rate, a shorter term, or both. A debt consolidation or cash-out. You can aggressively pay without that refinance and still come out way ahead. There's a lot of factors to consider when doing that with a house. Are you struggling with high-interest debts? Taking out a strategic cash-out refinance can help you pay them off. It involves converting part of your home. A cash-out refinance will give you money in a lump sum that you can use to pay for student loans and college expenses. The cash-out refinance interest rate may. Student loan refinancing allows you to gather all or some of your loans into one new loan, often at a lower interest rate that may help you pay less over time. The following requirements apply to cash-out refinance transactions: The transaction must be used to pay off existing mortgage loans by obtaining a new. A cash-out refinance is another way to go about combatting debt. It allows you to turn the home equity you've built up into cash that you can use for whatever. Refinancing via a conventional cash-out refinance, you could take out 80 percent of your home's equity. You would pay off the $k owed on your existing loan. Homeowners who have mortgage payments, as well as student loans from either their own education or their children's education, have the option to cash out. A mortgage refinance is when you get a new mortgage loan for your home, typically with a lower rate, a shorter term, or both. A debt consolidation or cash-out. You can aggressively pay without that refinance and still come out way ahead. There's a lot of factors to consider when doing that with a house. Are you struggling with high-interest debts? Taking out a strategic cash-out refinance can help you pay them off. It involves converting part of your home. A cash-out refinance will give you money in a lump sum that you can use to pay for student loans and college expenses. The cash-out refinance interest rate may. Student loan refinancing allows you to gather all or some of your loans into one new loan, often at a lower interest rate that may help you pay less over time. The following requirements apply to cash-out refinance transactions: The transaction must be used to pay off existing mortgage loans by obtaining a new. A cash-out refinance is another way to go about combatting debt. It allows you to turn the home equity you've built up into cash that you can use for whatever. Refinancing via a conventional cash-out refinance, you could take out 80 percent of your home's equity. You would pay off the $k owed on your existing loan.

Assuming you qualify for a lower interest rate when refinancing, choosing a shorter repayment term typically means that your monthly payments may be higher but. You could save an average of $4, annually when refinancing students loans into one easy payment. To refinance your student loans now or later? Visit the. Refinancing all your existing federal and/or private student loans into one new private consolidation loanFootnote 2 can potentially reduce your monthly payment. By setting a new repayment term, you can decide how quickly you want to pay off your loans. A shorter timeframe would mean making more aggressive monthly. A cash-out refinance allows homeowners to use their existing home equity to pay off student loans (and consolidate other debts). Learn more. One way to pay off your student loans is by taking out a student loan cash-out refinance. This wraps your debt into your mortgage and can save you money. Take control of your student loans. Customize your repayment plan for a lower monthly payment or faster payoff. Get a rate estimate in just 3 minutes. It doesn't cost anything to refinance student loans, and you may be able to reduce your monthly payment or pay off your debt faster. To decide if refinancing. If your lender requires your loan-to-value (LTV) ratio to be 80% or lower, then you can cash out no more than 80% of your home's value. This means that for. Refinancing federal, private or both types of student loans can help you pay off your student debt faster and work toward other financial goals, but the. If you decide refinancing is the best option to pay off your student loans, here's how it works: You get a cash-out refi loan that is larger than your current. Are you struggling with high-interest debts? Taking out a strategic cash-out refinance can help you pay them off. It involves converting part of your home. A Fannie Mae Student Loan Cash-Out Refinance loan, in simple terms, is a way for homeowners to use the equity in their home to pay off their student loans. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! With a cash-out refinance, you can take cash out from your home's equity to pay for anything you need. Why to finance an education. You must pay off at least one of your outstanding student loans with the proceeds and all money from your student loan cash out refinance will go directly to. Refinancing is the process of taking out a new loan to pay off your existing student loans. You can refinance both federal and private student loans. It's. A cash-out refinance can allow you to borrow from the equity you've built in your home and receive cash that can be used for just about anything like paying off. A cash-out refinance is when you replace your current mortgage with a larger loan and receive the difference in cash. Two important things to remember. Savings vary based on rate and term of your existing and refinanced loan(s). Refinancing to a longer term may lower your monthly payments, but may also increase.

Use Of Ftp

The File Transfer Protocol (FTP) is a standard communication protocol used for the transfer of computer files from a server to a client on a computer. Most universities have FTP servers that allow their students to download course materials, and upload assignment for submission. 5. Use FTP to transfer files. FTP is a simple, cross-platform way to transfer files if you have a reliable connection and need absolutely no security whatsoever (don't be. Blackbaud supports two secure FTP protocols to ensure that all file transmissions are secure and efficient; FTPS or 'FTP Secure' uses Transport Layer Security. "FTP" stands for File Transfer Protocol and it is method by which files can be transferred from one host computer to another; over a TCP-based network like the. FTP's ability to transfer large or large sets of files not only quickly but also reliably significantly minimizes the time that staff members spend on data. FTP (File Transfer Protocol) is a standard internet protocol used, as the name suggests, to transfer files between computers. FTP software uses a client server. FTP (File Transfer Protocol) is used to communicate and transfer files between computers on a TCP/IP (Transmission Control Protocol/Internet Protocol) network. FTP servers are the software solutions used for transferring files across the internet. They are primarily used for two essential functions, “Put” and “Get.” It. The File Transfer Protocol (FTP) is a standard communication protocol used for the transfer of computer files from a server to a client on a computer. Most universities have FTP servers that allow their students to download course materials, and upload assignment for submission. 5. Use FTP to transfer files. FTP is a simple, cross-platform way to transfer files if you have a reliable connection and need absolutely no security whatsoever (don't be. Blackbaud supports two secure FTP protocols to ensure that all file transmissions are secure and efficient; FTPS or 'FTP Secure' uses Transport Layer Security. "FTP" stands for File Transfer Protocol and it is method by which files can be transferred from one host computer to another; over a TCP-based network like the. FTP's ability to transfer large or large sets of files not only quickly but also reliably significantly minimizes the time that staff members spend on data. FTP (File Transfer Protocol) is a standard internet protocol used, as the name suggests, to transfer files between computers. FTP software uses a client server. FTP (File Transfer Protocol) is used to communicate and transfer files between computers on a TCP/IP (Transmission Control Protocol/Internet Protocol) network. FTP servers are the software solutions used for transferring files across the internet. They are primarily used for two essential functions, “Put” and “Get.” It.

On the Windows/PC side the most common are WS_FTP or CUTE-FTP. Windows95 also has an FTP client that runs in DOS, called simply FTP and run from the DOS command. FTP is a standard network protocol used for transferring files between a client and a server over a TCP/IP-based network, such as the internet. To use FTP effectively, you need to understand all the elements involved. One central element is the FTP port. You can only succeed in transferring files. File transfer protocol (FTP) is a method for moving files between computers on a network. It's a set of instructions that computers use to communicate and. Yes, unfortunately, FTP is still used in many legacy systems, even though it is insecure and provides passwords to anyone running wireshark. What is FTP? The FTP (File Transfer Protocol) utility program is commonly used for copying files to and from other computers. · Getting Started. To connect your. To make an FTP connection you can use a standard Web browser (Internet Explorer, Mozilla Firefox, etc.) or an FTP Client. To transfer a file with FTP you need. Use of standard TCP/IP network protocols to move files between machines. · Support for transfers to or from nonUNIX systems as well as among computers running. The File Transfer Protocol (FTP) is used to transfer files between two computers over a network and Internet. In this article we will look at how to work. Usage: Widely used for uploading and downloading files from a web server. FTP Clients: Includes software like FileZilla and WinSCP. Security: Traditional FTP is. The Many Uses of FTP · A website FTPs images from an internal server to populate page content · A company FTPs old archives of data from one server or computer to. The standard File Transfer Protocol (FTP) uses a client-to-server model. It does this by using two separate channels to move data between the client and server. FTP (File Transfer Protocol) is the simplest and fastest way to exchange files over the Internet. The most common use for FTP is to up/download files from the. FTP - File Transfer Protocol with computer network tutorial, features, types of computer network, components, cables and connectors, Router, Uses Of. FTP, also known as File Transfer Protocol, is a network protocol for transferring files – images, text, software, and others over a computer network. FTP, which stands for File Transfer Protocol, is a commonly used protocol for transferring files. Web admins, developers, and system administrators widely. Why Use FTP? You can think of FTP as file management for the internet. You can use it to copy, move, rename, delete, upload, edit, and download files and. FTP, which stands for File Transfer Protocol, is a commonly used protocol for transferring files. Web admins, developers, and system administrators widely. FTP is the most common TCP/IP application for moving files between computers. Copying files from one machine to another is one of the most frequently used.

What Is Home Owners Association

The HOA is established as a legal entity by the developer as a protection for his investment. It prevents the people that buy houses from him. An HOA, or Home Owners Association, is an organization that creates and enforces property and resident rules and guidelines for a subdivision, planned. A homeowner association or a homeowner community, is a private association-like entity in the United States, Canada, the Philippines and certain other. Homeowners Association. There are many variations in the usage of this term. It is sometimes used in the singular homeowner association. Some break it into. A homeowner association or a homeowner community, is a private association-like entity in the United States, Canada, the Philippines and certain other. The purpose of a homeowners association is to uphold the rules of the community, maintain common areas, and address resident issues. Like any nonprofit. A homeowners association (HOA) provides you with the chance of living in an orderly and well-run neighborhood that's managed by an organization that sets. Homeowners' Association General Information. Content_Area1. Homeowners' associations (HOAs) are entities created to manage or regulate, or to enforce covenants. A homeowners association is an organization created by a real estate developer to develop and manage a community of homes, town homes, or condominium units. The HOA is established as a legal entity by the developer as a protection for his investment. It prevents the people that buy houses from him. An HOA, or Home Owners Association, is an organization that creates and enforces property and resident rules and guidelines for a subdivision, planned. A homeowner association or a homeowner community, is a private association-like entity in the United States, Canada, the Philippines and certain other. Homeowners Association. There are many variations in the usage of this term. It is sometimes used in the singular homeowner association. Some break it into. A homeowner association or a homeowner community, is a private association-like entity in the United States, Canada, the Philippines and certain other. The purpose of a homeowners association is to uphold the rules of the community, maintain common areas, and address resident issues. Like any nonprofit. A homeowners association (HOA) provides you with the chance of living in an orderly and well-run neighborhood that's managed by an organization that sets. Homeowners' Association General Information. Content_Area1. Homeowners' associations (HOAs) are entities created to manage or regulate, or to enforce covenants. A homeowners association is an organization created by a real estate developer to develop and manage a community of homes, town homes, or condominium units.

Contacts · SC Secretary of State- To find out if an HOA is registered as a non-profit, visit the SC Secretary of State's website. · County Clerks of Court -. Shady Lane Easement · Membership is mandatory for all property owners within the boundaries of the development · Members are usually charged mandatory fees. A homeowners association (HOA) is an organization that makes and enforces rules and guidelines for a residential subdivision, planned community. HOA rules are standards to protect your investment. Want to learn more about HOA rules and how to change them? Discover the benefits and examples of common. HOA rules are standards to protect your investment. Want to learn more about HOA rules and how to change them? Discover the benefits and examples of common. Brooklyn Park has over Homeowners Associations (HOAs) that contain almost 40% of our single-family properties. Homeowner association A homeowner association (HOA) is an American real estate term. It is a corporation formed by a real estate developer to market, manage. Blue Springs is a community of neighborhoods. Working with our residents and Homeowner's Associations, we are committed to providing quality customer-service. To include or update information for your association: A map to locate Lacey homeowner and neighborhood associations is available through this website. For. The purpose of the California Association of Homeowners Associations is to provide Community Associations, Condominiums and Common Interest Developments,'. Homeowners associations (HOAs) are entities that enforce the rules for living in a community that chooses to be governed. They are common in planned. HOA-USA is dedicated to providing resources that promote a better understanding of town home, condominium, and single family homeowner associations in the. A homeowners association (or HOA) is the governing body that makes and enforces rules. In the real estate industry, that includes many of the rules that. Summary · A homeowner's association (HOA) is a dominant organization in housing developments that exercise greater control over the provision of services and. Homeowners Association. There are many variations in the usage of this term. It is sometimes used in the singular homeowner association. Some break it into. Homeowners associations act as governing boards to help maintain the common areas of shared living spaces. Your monthly or yearly HOA fee will often cover the. The civic associations possess similar objectives as homeowners' associations, but they lack real power since they are formed voluntarily and not legally bound. An HOA is an organization that sets and enforces rules and regulations for properties and residents within a housing development. A management certificate is a document recorded with the county that provides information about the management of a property owners' association (commonly known. A homeowners association (HOA) is a corporation that serves as the governing body of a residential community, such as a condominium, townhome, or single-family.

What Is The Best Interest Rate On A Home Loan

Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. Chase is one of the better big banks to get a home loan from as you can qualify for a relationship discount up to %. Your total interest rate discount. Today's Average Mortgage Interest Rates by Term ; Year Fixed. %. % ; Year Fixed. %. % ; Year Jumbo. %. %. Why is the interest rate for a 15‑year mortgage different than the rate for a 30‑year mortgage? · How do 15‑ or 30‑year fixed mortgage rates compare to. You do not need perfect credit · Down payments are generally low · Higher standards regarding home inspection · You can obtain max financing with a credit. Points are prepaid interest. if a $, loan has 1 point you'l owe the bank $ (1%) at closing and they lower your interest rate a little. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 1 basis point from % to % on Tuesday. Mortgage rates as of September 10, ; % · % · % · % ; $1, · $1, · $1, · $1, The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. Chase is one of the better big banks to get a home loan from as you can qualify for a relationship discount up to %. Your total interest rate discount. Today's Average Mortgage Interest Rates by Term ; Year Fixed. %. % ; Year Fixed. %. % ; Year Jumbo. %. %. Why is the interest rate for a 15‑year mortgage different than the rate for a 30‑year mortgage? · How do 15‑ or 30‑year fixed mortgage rates compare to. You do not need perfect credit · Down payments are generally low · Higher standards regarding home inspection · You can obtain max financing with a credit. Points are prepaid interest. if a $, loan has 1 point you'l owe the bank $ (1%) at closing and they lower your interest rate a little. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 1 basis point from % to % on Tuesday. Mortgage rates as of September 10, ; % · % · % · % ; $1, · $1, · $1, · $1, The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms.

View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Mortgage rates today ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($3,) ; yr fixed · % · % · ($3,). The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September 11 pm EST. Not all mortgages are created equal. Some mortgage lenders focus on a speedy preapproval process, while others may offer discounts on the interest rate or lower. In today's market, a good mortgage interest rate can fall in the low-6% range, depending on several factors, such as the type of mortgage, loan term, and. year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. On a. JP Morgan Chase: %; DHI Mortgage Company: %; State Employees' Credit Union (SECU): %; Navy Federal Credit Union*: %; Wells Fargo Bank. How do I get the best mortgage rate? The more likely it is you can make your mortgage payments, typically the better interest rate you'll get. What helps. Its an annual percentage rate that reflects, in addition to interest, some or all of the fees that apply to your mortgage loan. To understand how we calculated. Current mortgage and refinance interest rates ; % · % · % · % ; % · % · % · %. As of Sept. 12, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. As of Sept. 12, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. rate mortgage interest rate which is tied to the bond yield. Read about how Mortgage Loan Term – Choosing fixed rate mortgages can allow you to. Get Manulife Bank's best rates for high-interest bank accounts, mortgages, credit cards, loans and GICs. The mortgage rate roller coaster took a thrilling plunge, declining to its lowest level in nearly 15 months and dipping below % for the first time in. And when it's time to renew, RBC will guarantee your mortgage interest rate for 30 days prior to your renewal date. Choose What Works Best For You. With your. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Compare your interest rate options ; Monthly principal and interest payments stay the same. Monthly principal and interest payments can increase or decrease over. loans and lines of credit, and find what option works best for you Term. CIBC Home Power Plan Line of Credit. Get a lower interest rate by using the equity in.

Types Of Technical Jobs

The tech workforce consists of two primary components, represented as a single figure by the 'net tech employment' designation. The foundation is the set of. Information technology (IT) is the use of computer systems or devices to access information. Information technology is responsible for such a large portion of. As technology evolves, IT professionals are in high demand—so much so that they earn, on average, double the annual wage of other occupations. · IT offers. Types of occupations include those in application and product design, programming and development, data management and analytics, infrastructure and networking. Top Types Of Technical Analyst Jobs · Information Technology Supervisor · Customer Support Analyst · Cmms Analyst · Side Tech · Pos Implementation · Ehr Support. They apply their knowledge of computer technology, cyber security, electronic surveillance, encryption, and forensic science to safeguard information across the. Technologies and job titles such as C++ Development, C# Development, Java Development, Software Engineering, Linux Engineering, Unix Engineering, Network. Search the best Tech Jobs & Startup Jobs from top companies & startups in San Francisco Bay Area, CA. New jobs added daily. Explore engineering careers―specialists and technicians with associate degrees to engineers with bachelor's degrees. The tech workforce consists of two primary components, represented as a single figure by the 'net tech employment' designation. The foundation is the set of. Information technology (IT) is the use of computer systems or devices to access information. Information technology is responsible for such a large portion of. As technology evolves, IT professionals are in high demand—so much so that they earn, on average, double the annual wage of other occupations. · IT offers. Types of occupations include those in application and product design, programming and development, data management and analytics, infrastructure and networking. Top Types Of Technical Analyst Jobs · Information Technology Supervisor · Customer Support Analyst · Cmms Analyst · Side Tech · Pos Implementation · Ehr Support. They apply their knowledge of computer technology, cyber security, electronic surveillance, encryption, and forensic science to safeguard information across the. Technologies and job titles such as C++ Development, C# Development, Java Development, Software Engineering, Linux Engineering, Unix Engineering, Network. Search the best Tech Jobs & Startup Jobs from top companies & startups in San Francisco Bay Area, CA. New jobs added daily. Explore engineering careers―specialists and technicians with associate degrees to engineers with bachelor's degrees.

In an EY career, you'll work with clients to make positive change by helping to automate mundane, time-sapping work in every industry — from tax to HR, and. Manufacturing hiring event. Event Type: Military Location: Fort Hood/Cavazos Fort Cavazos, TX Registration Link: TBD. 8/6. Engineering Hiring event. Event Type. Special agent · Careers Built on Integrity · Special Agent · Uniformed Division Officers · Technical Law Enforcement · Administrative, Professional, Technical. The 10 Best Tech Jobs · 1. Data Scientist · 2. Software Developer · 3. Information Security Analyst · 4. Computer Systems Analyst · 5. Web Developer · 6. Sales. Careers in technology are available in various areas, including software engineering, web development, network engineering, data science, and IT support. Search the best Tech Jobs & Startup Jobs from top companies & startups in NYC, NY. New jobs added daily. Here are a few reasons to learn technology skills: Its definitions and types with Revature. You have what it takes to unlock a tech career. Search + job openings from tech's hottest employers. Salary estimations, career path tips and Insights to make your next career move the right one. Information Systems Technician (IT) ITs are system administrators that support the people and equipment required for every mission, including telephones. Interview Type: Technical Technical interviews are common for employers recruiting for engineering, science, or software roles. Essentially it is an interview. "IT manager job" gets 1, Google searches per month. "Software engineering job" gets 12, The job search is on and IT experts are in high demand across all. Search and apply for federal technology jobs. Learn about unique hiring paths for veterans, students and graduates, individuals with a disability, and more. Professions · Administration · Analytics · Business development and ventures · Business operations · Communications · Consulting services · Corporate technology. You're tenacious and driven, so the last place you want to work is some boring bank. Same. Learn about careers at Capital One and view jobs here. Job Types. From scientists and engineers to the administrative and technical staff that support the entire organization, NSF is where discoveries begin and. IT Positions · LAN Administrator · Network Installer · Applications Installers · System Architect · Data Communications Specialist · Web Engineer. Helpdesk. Start your tech career in · Cybersecurity · Data Analytics · IT Support · UX Design · Project Management · Java Development · a field you'll love. Explore Navy Careers · Choose Your Journey · HIGH-PRIORITY ROLES · Machinist's Mate Nuclear · Explosive Ordnance Disposal Technician · Information Systems Technician. Types of Engineering: Salary Potential, Outlook and Using Your Degree. Engineering professions typically fall under four different types: chemical, civil. Computing, technology and digital · 3D printing technician · App developer · Archivist · Business analyst · Cartographer · Computer games developer · Computer.

Va 5 1 Arm Rates

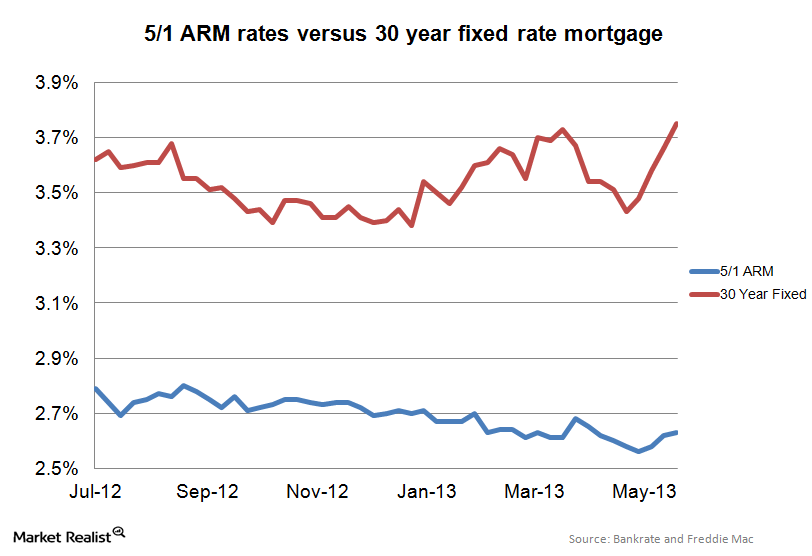

Compare current 5-year ARM rates from multiple lenders to find the best ARM rate. Get customized quotes for your 5-year ARM loan. Current VA Mortgage Rates ; Year Jumbo · % · % · 5/1 ARM. 5/1 Adjustable-Rate Mortgage Rates* ; , % ; , % ; , % ; , %. For the first five years, 5/1 ARM rates can be lower than year fixed-rate mortgages. After that, the interest rate and payments can increase significantly. These typically range from percent of the total loan amount. Unlike other loan types, the VA caps lender origination fees at 1 percent of the loan amount. How Much Can My Mortgage Payments Increase During the ARM Period? · The interest rate can increase by a maximum of 1% during the first adjustment. · The interest. 5/1, Provides a fixed interest rate for the first five years, offering stability and predictable payments. After the initial period, the rate adjusts annually. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed-Rate VA · Interest% · APR%. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. Compare current 5-year ARM rates from multiple lenders to find the best ARM rate. Get customized quotes for your 5-year ARM loan. Current VA Mortgage Rates ; Year Jumbo · % · % · 5/1 ARM. 5/1 Adjustable-Rate Mortgage Rates* ; , % ; , % ; , % ; , %. For the first five years, 5/1 ARM rates can be lower than year fixed-rate mortgages. After that, the interest rate and payments can increase significantly. These typically range from percent of the total loan amount. Unlike other loan types, the VA caps lender origination fees at 1 percent of the loan amount. How Much Can My Mortgage Payments Increase During the ARM Period? · The interest rate can increase by a maximum of 1% during the first adjustment. · The interest. 5/1, Provides a fixed interest rate for the first five years, offering stability and predictable payments. After the initial period, the rate adjusts annually. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed-Rate VA · Interest% · APR%. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %.

Average Mortgage Rates, Daily ; 5 Year ARM. %. % ; 3 Year ARM. %. % ; Jumbo. %. % ; VA. %. %.

Monthly payments that may change periodically · Adjustable-rate mortgages are a good choice if you: · Today's competitive rates† for adjustable-rate mortgages. What is an ARM VA loan? · 3/1 ARM — has a fixed interest rate for three years and adjusts each year after. · 5/1 ARM — has a fixed interest rate for five years. What is an adjustable-rate mortgage (ARM)? · 5-year ARM loans · 7-year ARM loans · year ARM loans. Choose an introductory fixed-rate period of 5, 7 or 10 years · Avoid mortgage insurance with an 80% LTV or lower · Refinance whenever you want; no prepayment. See today's 5/1 adjustable mortgage rates. Includes 5/1 ARM rates for conventional, FHA, and VA ARM loans. Find your lowest 5/1 ARM rate today. Adjustable-rate mortgage products have only been around since the s. As of , 7/1 ARM mortgage rates were around %, on average. On the contrary, the. Rates as of Aug 24, ET. Rates subject to change and displayed are "as low as" for purchase and refinances. Down-payment requirements vary based on the. Rocket Mortgage® offers 5/1 ARMs for VA loans. This means the rates stays fixed for 5 years before adjusting once per year based on an index every year after. Created with Highcharts Average 7/6 SOFR ARM Mortgage Rates 1% 2% 3% 4% 5% 6% 7% 8% Zoom 1YR 5YR ▾ MAX Aug Current VA mortgage and refinance rates ; VA year 5/1 ARM mortgage purchase. %. % ; year fixed rate VA refinance. %. % ; year fixed rate. Current ARM Rates ; % · VA 5/1 ARM · % · %. Compare current VA loan rates ; Visit First Federal Bank Mortgage Lenders site. NMLS # (26) 5/1 ARM VA. Points: 8 year cost: $, A VA loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included; therefore. interest rate adjustment on VA-guaranteed ARM loans. It is equal to the rate If the calculated interest rate is more than 1 percent higher or lower. Today, VA ARMs are in the form of hybrids, identified as 3/1, 5/1, 7/1 and 10/1. A hybrid is so-called because it mimics both a fixed rate and an ARM. The. The interest rate can increase over time and cause your mortgage payment to go up. 5. How does VA regulate “ARMS”? The interest rate cannot increase more than 1. Conventional, FHA, VA, Jumbo, ARM, Refinancing. Mortgage Rates. Higher than 5/1 ARM Loans FAQs. How do Adjustable-Rate Mortgages work? An adjustable. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. As of today, August 24th, , the year fixed VA loan purchase rate is % — the same as last week's average. Today's year fixed VA refinance loan. VA ARMs are typically available as 5/1 loans in which the introductory period interest rate is fixed for five years before adjusting every year after that. To.

Can I Settle My Credit Card Debt

Credit card debt settlement is a financial risk because you must go into it with the understanding that it will damage your credit. Your current credit score. In addition, failure to make required payments on your debts will negatively affect your credit score. Creditors are under no legal obligation to accept a. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. Be careful before using a debt settlement company. Your credit will decline and you may be faced with extreme collection efforts. Debt settlement companies. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. It is possible to negotiate directly with creditors and settle your debt for less than you owe, but you may want the help of a professional. A quick counseling. Some creditors will accept a 'full and final settlement'. This is when you pay off debts less that the total owed. You will need to have the money so you can. Debt settlement is a negotiated agreement in which a lender accepts less than the full amount owed – sometimes significantly less – to legally settle a debt. Debt settlement typically has a negative impact on your credit score. The exact impact depends on factors like the current condition of your credit. Credit card debt settlement is a financial risk because you must go into it with the understanding that it will damage your credit. Your current credit score. In addition, failure to make required payments on your debts will negatively affect your credit score. Creditors are under no legal obligation to accept a. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. Be careful before using a debt settlement company. Your credit will decline and you may be faced with extreme collection efforts. Debt settlement companies. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. It is possible to negotiate directly with creditors and settle your debt for less than you owe, but you may want the help of a professional. A quick counseling. Some creditors will accept a 'full and final settlement'. This is when you pay off debts less that the total owed. You will need to have the money so you can. Debt settlement is a negotiated agreement in which a lender accepts less than the full amount owed – sometimes significantly less – to legally settle a debt. Debt settlement typically has a negative impact on your credit score. The exact impact depends on factors like the current condition of your credit.

Important things to know You will not go to jail for having an unpaid credit You may be able to negotiate and settle your credit card debt, often for less. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. You can either initiate this negotiation on your own or work with a debt settlement company. Once you reach an agreement, you make a lump sum payment to the. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors. Going through debt settlement means you didn't pay off your debts in full at the time they were due. It results in a lower credit score and reflects poorly on. Some creditors will accept a 'full and final settlement'. This is when you pay off debts less that the total owed. You will need to have the money so you can. There are challenges to settling credit card debts that have reached the lawsuit and judgment stage. Before I address the challenges, I want to point out that. In fact, some credit card companies could refuse to work with debt settlement companies. Despite the promises made by debt settlement companies, you will not. The National Foundation for Credit Counseling (NFCC) is a nonprofit whose trained debt counselors could negotiate lower interest rates for you and consolidate. Settling debts on your own is possible, and we'll walk you through that process. But if you would like a hands-off approach to debt settlement, consider working. “Obviously, debt settlement is a better option for positive credit history versus not paying it at all and later dealing with collection agencies and its bad. It's a long process with no guaranteed results — but it will almost certainly tank your credit. Consider other options before turning to debt settlement, and if. You can settle business lines of credit and credit cards in the name of your S Corporation (C corp, LLC, and DBA's too), even with the personal guarantee. Paying off debt can seem impossible, but our Equifax Debt Management Center is here to help you learn strategies to help manage and pay off your debts. If the entry refers to an unpaid debt, contact the creditor to negotiate payment options. If there has been a dispute, you can ask the credit reporting agency. It can help you move on to accomplish other financial goals: You can apply for credit cards, loans, and mortgages right after your last settlement payment. CONS. These are the steps to follow: · 1. Work out what you can offer the people you owe · 2. Send your offer to them in writing · 3. Ask them to confirm they accept. Debt settlement can do long-lasting damage to your credit score, affecting your ability to get a loan, a credit card, or even housing or a job in the future. There is absolutely no difference scorewise between paying in full or settling for less, so it's almost always better to accept settlement. After all, settling your debt means that the interest and fees you're currently incurring on credit cards and other debts each month will stop accumulating.