irmanioradze.ru Learn

Learn

Amp Coin Market Cap

Amp price in US Dollar has decreased by % in the last 1 month. AMP is up % against Ethereum and down % against Bitcoin in the last 1 month. View the AMP (AMP) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. The current market cap of Amp is $M. A high market cap implies that the asset is highly valued by the market. What is the all time high of Amp? The all-. Amp price today is $ AMP price changed % in the last 24 hours. Get up to date Amp charts, market cap, volume, and more. CoinMarketCap (CMC) is a service that provides rankings of cryptoassets. It lists over million cryptocurrencies, including Bitcoin and Ethereum, and offers. The current price of Amp is $ per AMP. With a circulating supply of 80,,, AMP, it means that Amp has a total market cap of $,, The live HyperSpace price today is $0 USD with a hour trading volume of $0 USD. We update our AMP to USD price in real-time. Amp(AMP) Profile ; ATH. $ ; Price Change (1h). % ; Price Change (24h). +% ; Price Change (7d). +% ; Market Cap. $M. Amp's price today is US$, with a hour trading volume of $ M. AMP is % in the last 24 hours. It is currently % from its 7-day all-time. Amp price in US Dollar has decreased by % in the last 1 month. AMP is up % against Ethereum and down % against Bitcoin in the last 1 month. View the AMP (AMP) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. The current market cap of Amp is $M. A high market cap implies that the asset is highly valued by the market. What is the all time high of Amp? The all-. Amp price today is $ AMP price changed % in the last 24 hours. Get up to date Amp charts, market cap, volume, and more. CoinMarketCap (CMC) is a service that provides rankings of cryptoassets. It lists over million cryptocurrencies, including Bitcoin and Ethereum, and offers. The current price of Amp is $ per AMP. With a circulating supply of 80,,, AMP, it means that Amp has a total market cap of $,, The live HyperSpace price today is $0 USD with a hour trading volume of $0 USD. We update our AMP to USD price in real-time. Amp(AMP) Profile ; ATH. $ ; Price Change (1h). % ; Price Change (24h). +% ; Price Change (7d). +% ; Market Cap. $M. Amp's price today is US$, with a hour trading volume of $ M. AMP is % in the last 24 hours. It is currently % from its 7-day all-time.

With a circulating supply of 81 Billion AMP, Amp is valued at a market cap of $,,

The circulation supply of Amp is $,,, with a market cap of 42,,, AMP. In the past 24 hours, the crypto has increased by $ in its. Compare cryptocurrencies and stocks by market capitalization and find out their potential prices as well as other important stats. The current live price of Amp (AMP) today is USD with a current market cap of -- USD. AMP to USD price is updated in real-time. Key Amp market. Market Cap, M. Circulating Supply, B. Max Supply, N/A. Volume, 21,, Volume (24hr), M. Volume (24hr) All Currencies, M. Over the last 24 hours, the price has decreased by %. Amp currently has a circulating supply of B and a market cap of $M. AMP, the native. On the other hand, DigitalCoinPrice has a much more optimistic AMP crypto price prediction. The site suggests an average value of $ in and $ in. Amp Initial Market Cap. Initial Market Cap for Amp crypto project is the total value of available tokens in circulation at the time of the initial coin offering. The current market capitalization of Amp (AMP) is M USD. To see this number in a context check out our list of crypto coins ranked by their market caps. The live AMP price is ₹ with a price change of % in the last 24 hours. Convert, buy & sell AMP on Mudrex India's safest crypto platform. As of August AMP Limited has a market cap of $ Billion. This makes AMP Limited the world's th most valuable company by market cap according to our. Market Cap M; Circulating Supply B; Max Supply --; Volume 9,,; Volume (24hr) M; Volume (24hr) All Currencies M. Amp USD Overview. Amp. All About AMP ; $ · $ · $ Million · $ Million · 0xffcb7f73d4bde2e66ee58dc2. The current Amp usd price is $ We update the Amp USD price in real time. Get live prices of Amp on different cryptocurrency exchanges around the world. The market capitalisation of Amp is equal to the value of Amp multiplied by the number of Amp in circulation. Amp Price FAQ. What factors influence the price of. The current price of Amp is $ per AMP. With a circulating supply of 80,,, AMP, it means that Amp has a total market cap of $,, Amp's current share of the entire cryptocurrency market is %, with a market capitalization of $ Million. You can find more details about Amp on. Amp AMP ; CoinEx · AMP/USDT, $ , $ K ; irmanioradze.ru · AMP/USDT, $ , $ K. The current CoinMarketCap ranking is #, with a live market cap of $28,, USD. It has a circulating supply of 28,, AMPL coins and the max. supply. Learn what Amp (AMP) cryptocurrency is and today's market price. Confidently Asset Market Cap. Change over past 24 hours. as of 8/27/24 AM EDT. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates.

Is A Precious Metal Ira A Good Idea

If you want to use your tax-advantaged savings to purchase Gold and Silver, then a Precious metal IRA is definitely a good idea. In fact, a Precious metal IRA. Furthermore, precious metals have been a trusted store of value for centuries, making them an attractive investment option. With gold and silver. A precious metals IRA allows you to pair one of your most important portfolios—your retirement portfolio—with one of history's most impressive economic. A precious metals IRA is a self-directed IRA (SDIRA) that allows account owners to purchase alternative assets like gold, silver, platinum, and palladium. True portfolio diversification includes precious metals to immunize your savings from steep stock market crashes, currency devaluation, inflation, and deflation. Gold and other precious metals can help you diversify your retirement holdings. · Gold IRAs have strict rules that you must follow in order to comply with IRS. Investing in precious metals as part of diversified portfolio—along with stocks and bonds—may be a wise decision. However, even if they call themselves “IRA. Worried about protecting your hard-earned financial assets? Here's an idea that might help: a gold-backed IRA, or a precious metals-backed IRA - an IRA that. IRA Holders have been allowed to use funds in their IRA account to purchase approved precious metals since after the passage of the Taxpayer Relief Act of. If you want to use your tax-advantaged savings to purchase Gold and Silver, then a Precious metal IRA is definitely a good idea. In fact, a Precious metal IRA. Furthermore, precious metals have been a trusted store of value for centuries, making them an attractive investment option. With gold and silver. A precious metals IRA allows you to pair one of your most important portfolios—your retirement portfolio—with one of history's most impressive economic. A precious metals IRA is a self-directed IRA (SDIRA) that allows account owners to purchase alternative assets like gold, silver, platinum, and palladium. True portfolio diversification includes precious metals to immunize your savings from steep stock market crashes, currency devaluation, inflation, and deflation. Gold and other precious metals can help you diversify your retirement holdings. · Gold IRAs have strict rules that you must follow in order to comply with IRS. Investing in precious metals as part of diversified portfolio—along with stocks and bonds—may be a wise decision. However, even if they call themselves “IRA. Worried about protecting your hard-earned financial assets? Here's an idea that might help: a gold-backed IRA, or a precious metals-backed IRA - an IRA that. IRA Holders have been allowed to use funds in their IRA account to purchase approved precious metals since after the passage of the Taxpayer Relief Act of.

When you have a self-directed precious metal or gold IRA, you aren't limited to conventional investment assets like stocks, bonds and mutual funds. This gives. Precious metals like gold and silver can be great investments, including for your retirement fund. Learn how to buy gold in a Self-Directed IRA with the. One option many retirement savers use is to diversify their savings—and gold IRAs are one great way to hedge your savings against economic forces, because gold. Our preferred Precious Metal IRA Custodians will assist you with the creation and maintenance of your Precious Metals IRA. They will also provide their. A Traditional Precious metals IRA appeals to Investors who expect their tax rate to be lower during retirement. They set aside pre-tax income today for. Next, let's talk about the Vanguard Precious Metals and Mining Fund (VGPMX). This low-cost mutual fund invests in companies that mine and explore gold and other. Financial advisors and successful investors agree that asset diversification is the key to a lucrative investment portfolio. Precious metals are among some. A gold IRA or other precious metals IRA investment may help hedge against inflation or economic uncertainty. Discover storage requirements and other things. U. S. government regulations now allow a considerable range of gold, silver, platinum and palladium bullion and coins to be held as IRA investments. Why. There are a number of bullion options that are IRA approved, meaning that they are guaranteed to be legal for IRA investment opportunities. Investment bullion. Investing in precious metals is categorized as an alternative investment by the IRS and offers a hedge against market and currency flatters. Research also shows. The four precious metals allowed to be held in an individual retirement account are gold, silver, platinum and palladium, provided they are in the form of IRS-. I understand the allure of adding precious metals, including gold, into an investment portfolio. These assets are a good hedge against inflation, can. What is a Precious Metals IRA? A Precious Metals IRA is a special category of Individual Retirement Account (IRA) that allows investors to. Why Invest in a Precious Metals IRA Over a Paper-Backed IRA? Gold is a good place to put money these days given its value as a currency outside of the. Plus, gold IRAs can include a range of precious metals aside from just gold. Here, CNBC Select reviews a range of top-rated gold IRAs with low initial purchase. Also known as a precious metals IRA, traditional gold IRAs allow you to hold physical gold in your account, including gold bars and coins. As with all your. Investing in a precious metals IRA can be a great way to diversify your retirement portfolio and protect your savings from inflation. With a precious metals. Advantages of Precious Metals IRAs The benefits of gold IRA investing are four-fold: diversity, opportunity, safety, and control. Learn why this type of IRA. Tax Advantages: Precious Metal IRAs offer the same tax advantages as conventional IRAs. Depending on the type of IRA you choose (Traditional or Roth).

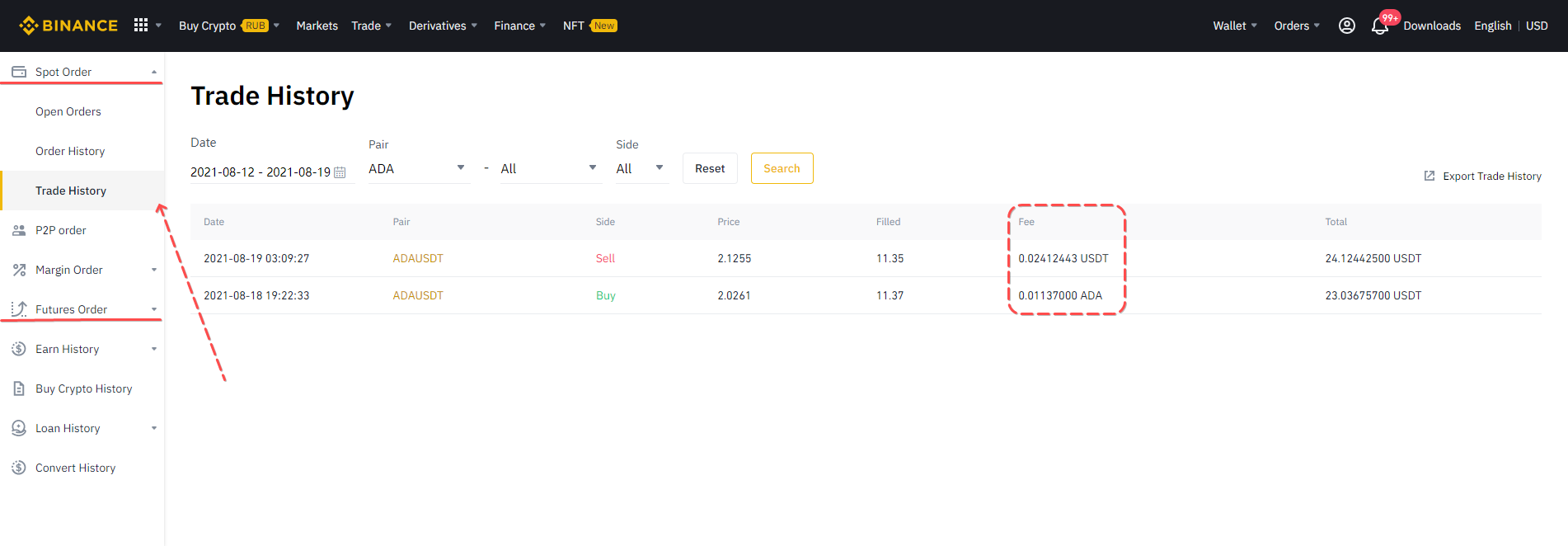

Binance Purchase Fees

Spot trading fees are % (not 1) and % if you own and use BNB to pay the fees whatever pair you trade (it's always a good idea to have. In contrast, Binance offers a slightly different fee model with a maker fee of % and a taker fee of %. These lower fees can benefit you if you perform. Our standard service fee is 25% for ETH; 30% for ADA, ATOM, DOT, SOL, and XTZ; and, up to 35% for other assets. See our Terms for more info. Spending with the Coinbase Card has no transaction fees. Coinbase does include a spread in the price to buy or sell cryptocurrencies. This allows us to. Buy #Crypto with ZERO Fees when using Visa or MasterCard on #Binance! ➡️ irmanioradze.ru The only trading fee is a flat % per trade. If you don't own Binance's own crypto, called BNB, this fee comes out of the crypto you purchase. For example. Binance charges a % trading fee when someone buys or sells coins on their platform. However, this fee can be reduced to as low as % if. Yes, Binance US charges a fee, however, it is the lowest fee charged with % to % as purchase and trading fees and 3% to % for debit card purchases. 2. Spot trading fees are % (not 1) and % if you own and use BNB to pay the fees whatever pair you trade (it's always a good idea to have. Spot trading fees are % (not 1) and % if you own and use BNB to pay the fees whatever pair you trade (it's always a good idea to have. In contrast, Binance offers a slightly different fee model with a maker fee of % and a taker fee of %. These lower fees can benefit you if you perform. Our standard service fee is 25% for ETH; 30% for ADA, ATOM, DOT, SOL, and XTZ; and, up to 35% for other assets. See our Terms for more info. Spending with the Coinbase Card has no transaction fees. Coinbase does include a spread in the price to buy or sell cryptocurrencies. This allows us to. Buy #Crypto with ZERO Fees when using Visa or MasterCard on #Binance! ➡️ irmanioradze.ru The only trading fee is a flat % per trade. If you don't own Binance's own crypto, called BNB, this fee comes out of the crypto you purchase. For example. Binance charges a % trading fee when someone buys or sells coins on their platform. However, this fee can be reduced to as low as % if. Yes, Binance US charges a fee, however, it is the lowest fee charged with % to % as purchase and trading fees and 3% to % for debit card purchases. 2. Spot trading fees are % (not 1) and % if you own and use BNB to pay the fees whatever pair you trade (it's always a good idea to have.

The maker fees are trading commissions applied by the exchange to pending orders, such as a sell stop order or a buy limit order. The taker fees instead are. Well, by default Binance charges 1% as trading fees, and by following the tricks mentioned in this article and embedded video, you will be able to save a. The maker fees are trading commissions applied by the exchange to pending orders, such as a sell stop order or a buy limit order. The taker fees instead are. You'll pay a transaction fee when you send crypto on most blockchain networks. Transaction fees act as an incentive for miners or validators to process. Purchase Fees. If you choose to buy your cryptocurrencies with a debit or credit card, you can expect to pay up to % in fees. · Deposit Fees · Trading Fees. However, you can use a crypto tax calculator like Koinly to get your Binance tax forms easily. How do I get my Binance tax documents? To include your Binance. irmanioradze.ru is the leading crypto platform trusted by millions of customers in the U.S. Securely buy and sell bitcoin and + cryptocurrencies with some of. Trading Fees · Using BNB to pay for fees · What are the Trading Fees on irmanioradze.ru? · irmanioradze.ru Announces Zero-Fee Trading for Bitcoin with New Fee Schedule |. Start your crypto portfolio in as little as two minutes. Easily trade BTC with $0 fees on a select pair. All it takes is a few quick taps to start trading on. Trading Fees · Most Stablecoins and major market FX: % · BTC, ETH: % - % · Altcoins: % - % · Precious Metals: % - %. Explore Binance deposit & withdrawal fees for various cryptocurrencies on the world's leading exchange. Find transparent rates for smooth transactions. Yes, both Binance and Coinbase charge fees for buying Bitcoin. On Binance, there is a % fee for all trades, including Bitcoin purchases. On. Binance withdrawal fees compared to 22 exchanges, by nominal and fiat value, as of Sep 2, Bitcoin: BTC ($), Ethereum: ETH ($). Kraken has zero withdrawal fees, and Binance charges a flat withdrawal fee to cover the transaction costs. In , Bybit adjusted the fees for derivatives. fees, set transaction fees, or tiered transaction fees based on trading volume. Most people who use irmanioradze.ru will be charged fees and have withdrawal limits. I am calculating with a taker fee (since I intend on buying with the market price) of %. I assume that if I want to buy any crypto for $ I pay *(0. Currently, Binance charges a flat fee of % of the notional value of the contract, which is competitive compared to other exchanges. Deposit & Withdrawal. Binance charges a fee of % for all trades. It also offers a 50% discount on fees for trades made using Binance Coin. Binance VS Coinbase: Binance fees. Binance Trading Fees Explained. In general, you will have to deal with a % spot trading fee and a % Instant Buy/Sell fee. However. A % fee is applied for credit card purchases, % for Coinbase wallet or bank account purchases, and wire transfers are $10 for deposits and $25 for.

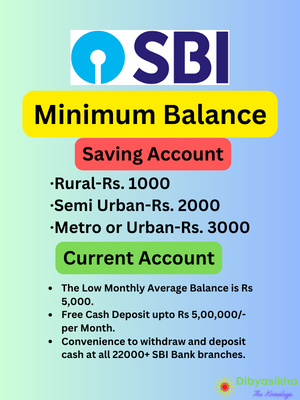

Which Bank Has Lowest Minimum Balance

BECU Checking. Our free checking has no maintenance fees, and no required minimum balance. Open an Account. Checking Rates. Features · % per year on new funds deposited from to 30 September · Instant account opening through the FAB Mobile app or Online Banking. Learn about qualifying direct deposits. Or. Maintain a minimum daily balance of $1, or more in your account This fee is charged when your account has. A money market account typically has a higher opening and minimum balance requirement than traditional savings accounts, often around $2, Money market. FDIC Insured. Your savings account will be FDIC insured up to the maximum limits allowed by law ; Low Minimum. Open a new account with as little as $ ; No Fees. There are two major offerings in the market for zero balance accounts. They are Kotak Mahindra Bank's account and Axis Ban's ASAP account. Maintain a minimum daily balance of $ or more in your account; OR; Ask us to link your Advantage Savings account to your Bank of America Advantage. The best high-yield savings accounts have high APYs, low fees and are federally insured. We picked the TAB Bank High Yield Savings account because it's one of the best options for earning a high yield with no minimum deposit requirement to worry. BECU Checking. Our free checking has no maintenance fees, and no required minimum balance. Open an Account. Checking Rates. Features · % per year on new funds deposited from to 30 September · Instant account opening through the FAB Mobile app or Online Banking. Learn about qualifying direct deposits. Or. Maintain a minimum daily balance of $1, or more in your account This fee is charged when your account has. A money market account typically has a higher opening and minimum balance requirement than traditional savings accounts, often around $2, Money market. FDIC Insured. Your savings account will be FDIC insured up to the maximum limits allowed by law ; Low Minimum. Open a new account with as little as $ ; No Fees. There are two major offerings in the market for zero balance accounts. They are Kotak Mahindra Bank's account and Axis Ban's ASAP account. Maintain a minimum daily balance of $ or more in your account; OR; Ask us to link your Advantage Savings account to your Bank of America Advantage. The best high-yield savings accounts have high APYs, low fees and are federally insured. We picked the TAB Bank High Yield Savings account because it's one of the best options for earning a high yield with no minimum deposit requirement to worry.

Minimum Balance of Top Banks ; Union Bank of India. Available. With Cheque book - Rs Without Cheque book - Rs ; HDFC Bank. Not available. Rs.2, ; ICICI. bank beforehand and comparison shop for the lowest and least fees. Savings Account, Monthly Maintenance Fee (if not waived), Account Minimum. Wells Fargo. Features · % per year on new funds deposited from to 30 September · Instant account opening through the FAB Mobile app or Online Banking. Monitor your account with real-time updates such as low balance alerts or suspicious activity notifications. Is there a minimum balance required for a. No minimum balance required. · No minimum deposit to open your account. · Fifth Third Extra Time ® gives you more time to make a deposit and avoid overdraft fees. This bank's MMA offers a high APY of 5%, a low minimum deposit of $50, and no maintenance fees. You can tap the cash in your MMAs with checks, but you'll be. Minimum balance required to avoid monthly service fees. Monthly maintenance Low balance alert notifications. CHECKLIST FOR OPENING A BANK OR CREDIT. It has no monthly fee, minimum deposit requirement or balance requirement. Low minimum balance to earn interest; No balance caps on highest APY; Interest. For bank accounts, the minimum balance is the minimum dollar amount that a customer must have in an account to receive some service benefit, such as keeping. With accounts built for every stage of life, you'll get free Online Banking, Mobile Banking, no fees at TD ATMs, plus overdraft options to help you avoid fees Add money to your account: A minimum deposit of $25 for a Bank Smartly® Savings account or $ for an Elite Money Market account is all it takes to get started. Why we picked it. With a % APY and a low minimum opening deposit of $, Evergreen Bank Group's high-yield savings account is accessible and affordable. a lower minimum balance. $1, Minimum Balance A single-deposit savings account that has a higher interest rate and requires a higher minimum balance. With a % APY and a low minimum opening deposit of $, Evergreen Bank Group's high-yield savings account is accessible and affordable. You can sign up. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. What type of savings accounts does Bank of America offer? Bank of America offers savings solutions to help meet your goals. Consider the following savings. Accessibility: Make sure the bank you choose offers convenient ways to access your cash, such as in-network ATMs or quick fund transfers. Low fees: Nothing. What is the most important feature for you when looking for a checking account? Interest bearingLow minimum balance to open. Are you over 50, a veteran. Find the best account for you · Checkless banking with no overdraft fees · Most flexible banking options with check writing and digital payments · Discounts on. Chase Secure Banking has been certified by Bank On for meeting the National Account Standards as a low-cost, low-fee account since No overdraft fees —.

Market Movers Investing

Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more. Investing · Markets Now · Before the Bell Get the latest updates on post-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Hottest stocks trading today on the U.S. Markets. Gainers and decliners of the largest equities on the S&P , Nasdaq Composite and Dow Jones Industrial. Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner, or investment manager. The Market Movers page provides users with insight into what segments of the overall financial markets have moved the most on the current day. Perform stock investment research with our IBD research tools to help investment strategies. We provide the resources to help make informed decisions. Hear our experts take on stocks, the market, and how to invest. Motley Fool Returns. Motley Fool Stock Advisor. Market-beating stocks from our award-. U.S. Stock Movers ; Pono Capital Two Inc. Cl A (PTWO) · Pono Capital Two Inc. Cl A (PTWO). K · ; Redfin Corp. (RDFN) · Redfin Corp. (RDFN). M · Today's biggest gainers, market losers, and the most traded stocks by volume. Use the Market Screener, on MarketWatch, to browse global stock markets performance for the latest trends, historical data and more. Investing · Markets Now · Before the Bell Get the latest updates on post-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Hottest stocks trading today on the U.S. Markets. Gainers and decliners of the largest equities on the S&P , Nasdaq Composite and Dow Jones Industrial. Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner, or investment manager. The Market Movers page provides users with insight into what segments of the overall financial markets have moved the most on the current day. Perform stock investment research with our IBD research tools to help investment strategies. We provide the resources to help make informed decisions. Hear our experts take on stocks, the market, and how to invest. Motley Fool Returns. Motley Fool Stock Advisor. Market-beating stocks from our award-. U.S. Stock Movers ; Pono Capital Two Inc. Cl A (PTWO) · Pono Capital Two Inc. Cl A (PTWO). K · ; Redfin Corp. (RDFN) · Redfin Corp. (RDFN). M · Today's biggest gainers, market losers, and the most traded stocks by volume.

The Top Gainers Today is a tool that provides real-time information on the top-gaining stocks in the US market today. This product is designed to help. Markets · US Market Barometer · Market Movers · Featured · Recommended · Company Earnings · Funds · Stocks. Stock movers ; IIP-UN-T · Interrent Real Estate Investment Trust, ; DND-T · Dye & Durham Ltd, ; SXP-T · Supremex Inc, ; MND-T · Mandalay Resources Corp. TheStreet covers the most engaging stories about how to make money, invest your money, save your money, and spend your money. US companies below are top stock gainers: they've shown the biggest daily growth in price. Top website in the world when it comes to all things investing. Not only do we keep investors fully informed with up-to-the-minute market coverage, but we also provide a long-term perspective on the stock market and economy. Market movers was incepted to help provide high-level investment information and education to its members. We aim to create and cater to investors of all skill. Get the list of the largest post-market gainers with all the stats for a detailed analysis to achieve the most effective after-hours trading — US stocks. During trading sessions, investors—and especially traders—want to be where the action is. The problem is scanning a list of stocks and mutual funds won't. Markets · Market MOVERS. S&P NASDAQ DOW EUR ASIA COVID TOP. BLDR · Builders Investing Club. Jeff Marks; Paulina Likos; Friday, August 23, The Club. Premarket trading coverage for US stocks including news, movers, losers and gainers, upcoming earnings, analyst ratings, economic calendars and futures. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Investing · Barron's · Best New Ideas · Stocks · IPOs · Mutual Funds · ETFs · Options Options market says it's unlikely. Premarket Screener. Home · Tools. After Hours Gainers ; 5, SGBX, Safe & Green Holdings Corp. %, ; 6, LCW, Learn CW Investment Corporation, %, Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. Subscribe Now ->. How does Nasdaq define the "Ten. Premarket Trading After Hours Trading Market Movers S&P Volume Burst M, M. N. N2OFF Inc Joins the EU PV Market: Investing in MW Project in. U.S. Stock Movers NVIDIA Corp. Tesla Inc. Peloton Interactive Inc. Faraday Future Intelligent Electric Inc. View full tableView extended-hours trading. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset. U.S. Stock Movers ; ASTS. AST SpaceMobile. $, $ ; MARA. Marathon Digital Holdings. $, $ ; CRWD. CrowdStrike Holdings. $, $ ; PLTR. Information about the economy and the prospects of specific companies comes in, and the market reacts. Sometimes those reactions are extreme, but they usually.

Cost To Paint 2200 Sq Ft House Interior

The cost of an interior painting project ranges between $ and $3,, with a national average of $2, At about $2 to $6 per square foot for both materials. Typically, a sq ft house painting costs varies from Rs 30, to Rs 60, with emulsion paint and distemper. More from Knowledge Centre. Stay updated on. This could range from $ - $50, without any other details. Ah, the impossible question. So many details go into pricing a paint job. Here is a breakdown of the cost of painting your house per square foot in India*. We also give you a detailed understanding of why these costs are different and. Actual prices will vary based on square footage, number interior painting project cost approximately $1,, Interior painted house with windows. Interior paint coverage depends on the brand of paint used. The Paint usually is applied at to square feet per gallon (primer at The majority of painting contractors charge by the square foot ranging from $ to $ per square foot and the average cost is around $ per sq. ft. Interior paint coverage depends on the brand of paint used. The Paint usually is applied at to square feet per gallon (primer at On average, professional painters charge between $ and $ per square foot of a home's floor space to prime, paint, and seal walls. The cost of an interior painting project ranges between $ and $3,, with a national average of $2, At about $2 to $6 per square foot for both materials. Typically, a sq ft house painting costs varies from Rs 30, to Rs 60, with emulsion paint and distemper. More from Knowledge Centre. Stay updated on. This could range from $ - $50, without any other details. Ah, the impossible question. So many details go into pricing a paint job. Here is a breakdown of the cost of painting your house per square foot in India*. We also give you a detailed understanding of why these costs are different and. Actual prices will vary based on square footage, number interior painting project cost approximately $1,, Interior painted house with windows. Interior paint coverage depends on the brand of paint used. The Paint usually is applied at to square feet per gallon (primer at The majority of painting contractors charge by the square foot ranging from $ to $ per square foot and the average cost is around $ per sq. ft. Interior paint coverage depends on the brand of paint used. The Paint usually is applied at to square feet per gallon (primer at On average, professional painters charge between $ and $ per square foot of a home's floor space to prime, paint, and seal walls.

Painting all the walls and ceilings for the living space of this square foot home was a total cost of $24, This estimate also included all the closets. Breaking that down, you can count on paying between 13 and 20 cents per square foot of painted surface area per coat of paint. Given that most painting projects. The typical rule-of-thumb is one gallon for about every three to four hundred square feet. However, some paint formulas and wall textures may require more. Interior paint coverage depends on the brand of paint used. The Paint usually is applied at to square feet per gallon (primer at On average, the cost of painting a square foot house can range from $2, to $5, This estimate includes both labor and materials. A standard 3 bed, 2 bath suburban home usually spans about 1,, square feet. Expect to pay $2,$3, to paint the walls of the entire interior for a. With all the painting materials and supplies from a professional company, the average price to paint the exterior of a home can range from $$ per sqft. The cost of painting ceilings will range from $1 to $ per square foot. The final price will depend on whether it is a flat ceiling, how high the ceilings. Typically, a sq ft house painting costs varies from Rs 30, to Rs 60, with emulsion paint and distemper. More from Knowledge Centre. Stay updated on. So the painting estimate for a 1,square-foot house would be anywhere from $3,$5, plus HST. This is interior painting costs. Ceilings can cost between. A 4, square feet interior painting job will usually cost around $6, to $12, The exact price depends on several factors such as the materials, time of. Painting all the walls and ceilings for the living space of this square foot home was a total cost of $24, This estimate also included all the closets. Pricing Includes Paint Cost ; Large Room 15 x 20 ; Large Room 15 x Wall Surface, Sq Ft, $ ; Large Room 15 x 20 · Prep & Masking, Varies, $ The basic cost to Paint a Two Story House is $ - $ per square foot in April , but can vary significantly with site conditions and options. The average cost for painting a house in India ranges from INR 20 to INR 50 per square foot. Considering a 1, square foot house, the. Larger properties, like a 3, square foot house, might incur expenses of $7, to $8,, while a 3, square foot home could cost between $8, and $8, The cost of painting ceilings will range from $1 to $ per square foot. The final price will depend on whether it is a flat ceiling, how high the ceilings. The average exterior house painting cost in Los Angeles ranges from $4 to $6 per square foot. · Painting the interior of a typical Los Angeles home costs between. Painting costs vary widely, averaging $3, but ranging from $1, to $13, based on home size, siding type and prep work. The cost to paint exterior siding.

Good Stocks To Look Into

Everything else is kind of meh. I would look into tech if I was you Great management team and have been on track with everything. To evaluate quality, use a simple trick: look at the S&P Earnings and Dividend Rating of the company. Graham suggests that any company with a rating of 'B' or. Best stocks by one-year performance ; Progressive Corp. (PGR). % ; Arista Networks Inc (ANET). % ; Constellation Energy Corporation (CEG). %. You can read more about our methodology on selecting the best $0 commission trading platforms below. Bottom line. Before you jump into the complicated and risky. In after-hours action, Nordstrom advanced 7% after the retailer posted adjusted earnings in the second quarter that surpassed expectations. The good news is that you can find most of the answers to these Always remember to consider how an investment in a given stock will fit with. Income-oriented investors focus on buying (and holding) stocks in companies that pay good dividends regularly. check out the stocks they're investing in. This. Quick Look at Best Stocks for Day Trading: · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · See All 15 Items. Stocks ; NVDA NVIDIA Corporation. (%). , %, M ; INND InnerScope Hearing Technologies, Inc. (%). -, -, M. Everything else is kind of meh. I would look into tech if I was you Great management team and have been on track with everything. To evaluate quality, use a simple trick: look at the S&P Earnings and Dividend Rating of the company. Graham suggests that any company with a rating of 'B' or. Best stocks by one-year performance ; Progressive Corp. (PGR). % ; Arista Networks Inc (ANET). % ; Constellation Energy Corporation (CEG). %. You can read more about our methodology on selecting the best $0 commission trading platforms below. Bottom line. Before you jump into the complicated and risky. In after-hours action, Nordstrom advanced 7% after the retailer posted adjusted earnings in the second quarter that surpassed expectations. The good news is that you can find most of the answers to these Always remember to consider how an investment in a given stock will fit with. Income-oriented investors focus on buying (and holding) stocks in companies that pay good dividends regularly. check out the stocks they're investing in. This. Quick Look at Best Stocks for Day Trading: · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · See All 15 Items. Stocks ; NVDA NVIDIA Corporation. (%). , %, M ; INND InnerScope Hearing Technologies, Inc. (%). -, -, M.

Get the latest updates on Wall Street's hot stocks from investment experts on our panel. Be a A Look at Amazon's Growth Potential & Market Risks. By Tezcan. Investing Lists · Value Stocks · Shareholder Yield Stocks · Small Cap Value Stocks · Growth At A Reasonable Price Stocks (GARP) · Wide Moat Stocks · Momentum Stocks. Log in to view the top rated stocks in each sector, based on the Equity Summary Score. The Equity Summary Score provides a consolidated view of the ratings. 1. Define your goals. Before thinking about how to pick a good stock to invest in, you need to consider your investment goals. Updated for ! Here's a list of top stocks to buy, along with a framework for how to identify some of the best stocks around. in EUR, but obviously many good swing trade opportunities occur in US stocks. Should I look for the trade triggers on the original exchanges (NYSE etc.) in. Barchart ranks best and worst performing stocks to buy by highest weighted alpha (measure of how much a stock has changed in the one year period). Artificial intelligence can make stock picking seem easy. You can use search prompts like "best dividend income stocks" and "best growth stocks" to find. Choosing stocks summed up. To pick the best stocks to invest in, consider factors such as the outcome you're trying to achieve, your attitude to risk, as. HIMS, consumer healthcare. Very little moat but getting good growth numbers. INDI, semiconductors for automotive industry. This one looks. As an investor, it's easy to fall into the trap of believing that there are tricks to picking the best stocks. Filters which enable site visitors to look at. The tips in this lesson will help you become an informed, confident investor who knows what to look for when approaching the stock market and researching the. Look inside this book. Good Stocks Cheap: Value Investing with Confidence for a Lifetime of Stock Market Outperformance by. Kenneth Jeffrey Marshall. Good. Discover top stocks for Explore eToro's insights on NVIDIA, First Solar, Schlumberger, Constellation Brands, and Albemarle now. Even experienced investors grapple with choosing the best stocks. Beginners should look for stability, a strong track record, and the potential for steady. Trade Strong Stocks in an Uptrend, Weak Stocks in a Downtrend. To choose the best stocks for intraday trading, most traders will find it beneficial to look at. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. After compiling a list of candidates, it's time to look for those with good entry points. Two common entry strategies are either to look for breakouts in the. For you to find good stocks to buy or invest in, you need to check these below-mentioned points. These are some things to know before investing in stocks.

What Is The Safest Type Of Mutual Fund

You want to buy a house in 5 years so you need safety for your money. I wish there was a conversion tool that you could type in your mutual. Think of mutual funds as a collection of investments. They can include stocks, bonds, and other types of investments. Mutual funds can help you by spreading. Learn more about the different types of investments, including funds, stocks, and alternatives, to determine which assets can best meet your financial. The best no-load mutual funds ; Fidelity Blue Chip Growth, FBGRX ; Heartland Mid Cap Value, HRMDX ; Mairs & Power Growth, MPGFX ; T. Rowe Price Dividend Growth. Savings funds · Low risk · Steady level of income with a focus on preserving capital · Accessible any time. As a money market fund investor, you are paid income in the form of dividends. Because money can be easily transferred between the cash instruments and other. These funds can provide you with some interest income and liquidity, while maintaining a high level of safety for your investment. The income provided by these. A mutual fund is a type of investment vehicle where the money collected from various investors is pooled together to invest in different assets. Take advantage of some safety of investment and a majority on income generating funds. These funds are low to medium risk and usually include fixed income and. You want to buy a house in 5 years so you need safety for your money. I wish there was a conversion tool that you could type in your mutual. Think of mutual funds as a collection of investments. They can include stocks, bonds, and other types of investments. Mutual funds can help you by spreading. Learn more about the different types of investments, including funds, stocks, and alternatives, to determine which assets can best meet your financial. The best no-load mutual funds ; Fidelity Blue Chip Growth, FBGRX ; Heartland Mid Cap Value, HRMDX ; Mairs & Power Growth, MPGFX ; T. Rowe Price Dividend Growth. Savings funds · Low risk · Steady level of income with a focus on preserving capital · Accessible any time. As a money market fund investor, you are paid income in the form of dividends. Because money can be easily transferred between the cash instruments and other. These funds can provide you with some interest income and liquidity, while maintaining a high level of safety for your investment. The income provided by these. A mutual fund is a type of investment vehicle where the money collected from various investors is pooled together to invest in different assets. Take advantage of some safety of investment and a majority on income generating funds. These funds are low to medium risk and usually include fixed income and.

Mf equity investment is based on stock market. In mf investment in there two types of investments are there 1. Equity 2. Debt.. Normally we are. A balanced fund is geared toward investors who are looking for a mixture of safety, income and modest capital appreciation. Money market fund: A type of. Mutual Funds are subject to various risk factors depending on the type. Learn about High Risk Equity Funds & Low Risk Equity Funds and invest smartly. Mutual funds are a simple, affordable way to diversify your portfolio and benefit from professional investment management. These funds provide investors with a mixture of safety, income and capital appreciation. They will hold fixed-income securities for stability and income, as. Asset class and type. Money market. Balanced Funds and Portfolio Solutions. Fixed income. Equity. Liquid alternatives. Regions. Canada. U.S.. North America. Mutual funds are market linked safe investments which invest in equity related securities and money market instruments. Click here to read the full article. Top 25 Mutual Funds ; 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index. Banks may also offer “insured” mutual funds in the tax-exempt municipal fund market. Despite the name, these investments are not protected by the FDIC. The. Why invest in mutual funds? Because there are funds based on specific trading strategies, investment types, and investing goals. Choosing your own mix of funds. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The payment of distributions is not guaranteed and may. For mutual fund investors, a diversified portfolio could include a combination of money market funds for safety; bond funds for income; and equity mutual funds. Mutual Funds are subject to various risk factors depending on the type. Learn about High Risk Equity Funds & Low Risk Equity Funds and invest smartly. Equity Funds focus on a particular type of investment strategy such as Growth, Value, Large Caps and Small Caps or themes such as Property, Energy and. Mutual funds are the most common type of investment fund. In Canada, there are about 3, mutual funds designed for small, medium and large investors. You. Liquid Mutual funds are the safest Mutual funds. As the investments in Liquid MFs are insulated from Stock Markets, the turbulances in the stock. Investors should be aware that by investing in a mutual fund, there is no guarantee of any income distribution, returns or capital appreciation. Key Takeaways There are different types of mutual funds designed to meet various investment goals and risk appetites. As the most popular type, equity funds. While there are numerous, each mutual fund will fall into one of the three main asset classes: safety, income or growth. Or, you can choose a balanced fund. Franklin Templeton is a global leader in asset management with more than seven decades of experience. Learn more about our range of mutual funds and ETFs.

How To Open A Retirement Account

The first step in opening an IRA is to select the option that fits your individual investment style. It's important to know that application instructions vary. There is no minimum balance required to open your Account, to avoid being charged a fee, or obtain the Annual Percentage Yield (APY) disclosed to you. 2 For a. Schwab offers multiple types of individual retirement accounts (IRAs) to help meet your retirement goals. Open an IRA account. You're only a few taps away—sign up for Stash, pick your plan, open your IRA account, and start investing for retirement in minutes. Stash makes future planning. Using both an IRA and an employer-sponsored plan provides the opportunity to invest more for your retirement. Find out more from PNC Investments. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. IRAs are retirement savings accounts that help you save for your retirement. Discover the different types of IRAs for your retirement savings needs. So if you have your money in a (k) or (b) or another IRA, you can open a traditional IRA with Principal by moving that money directly, with no tax. Step 4: Open an account. Opening an IRA account involves proving that you are who you say you are by providing personal documentation to support your identity. The first step in opening an IRA is to select the option that fits your individual investment style. It's important to know that application instructions vary. There is no minimum balance required to open your Account, to avoid being charged a fee, or obtain the Annual Percentage Yield (APY) disclosed to you. 2 For a. Schwab offers multiple types of individual retirement accounts (IRAs) to help meet your retirement goals. Open an IRA account. You're only a few taps away—sign up for Stash, pick your plan, open your IRA account, and start investing for retirement in minutes. Stash makes future planning. Using both an IRA and an employer-sponsored plan provides the opportunity to invest more for your retirement. Find out more from PNC Investments. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. IRAs are retirement savings accounts that help you save for your retirement. Discover the different types of IRAs for your retirement savings needs. So if you have your money in a (k) or (b) or another IRA, you can open a traditional IRA with Principal by moving that money directly, with no tax. Step 4: Open an account. Opening an IRA account involves proving that you are who you say you are by providing personal documentation to support your identity.

Roth IRA · Pay taxes now. · Receive tax-free withdrawals from qualified distributions. · May be a good option if you're in a lower tax bracket. · Minimum investment. A savings IRA account can help you make the most of your hard-earned retirement. Explore IRA options from Bank of America and open an account online today. How to fund your IRA Most banks and financial institutions offer several ways for you to fund your retirement account. Among the most popular methods is to. You can open a Roth IRA at an online broker and then choose your own investments. You can build a diversified portfolio with just three or four mutual funds. Step 3. Open your IRA online quickly & easily. Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank. Open a Traditional or Roth IRA account. With a Citibank IRA, you can choose to deposit your funds in a money market account or CD. Learn how to open an IRA. Open a traditional IRA with Alliant Credit Union and get tax deductible contributions and tax deferred earnings. Our IRA rates are among the best in the. There's no charge to open a Vanguard IRA. The fund or product you choose may have a minimum investment amount. Minimum investments for Vanguard mutual funds can. How to open a Traditional IRA · Start your online Traditional IRA application · Fund your Traditional IRA by making a contribution or rolling over money from your. Even if you've signed up for an employer-sponsored plan like a (k), (b) or TSP, you can still open an IRA to boost your savings and add flexibility to. You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others. Discover how to grow your earnings tax-deferred for retirement with a traditional IRA. Open a traditional IRA from the top IRA provider, Fidelity. A savings IRA account can help you make the most of your hard-earned retirement. Explore IRA options from Bank of America and open an account online today. Registration is open for all employers. Savers contribute a portion of each paycheck to an Individual Retirement Account (IRA) that belongs to them. Open a traditional IRA at any age as long as you have taxable income. Unlike the Roth IRA, there's no maximum income limit. You pay taxes on your investment. Which Wells Fargo IRA is right for you? For more information, contact a Wells Fargo Retirement Professional at How to open an IRA. You can easily open and fund an IRA. Whether you prefer investing on your own or want personal investment guidance, we have options. Rollovers. Many savers open an IRA to “roll over” funds from existing retirement accounts like a (k). But in reality, a Rollover IRA is a traditional IRA or. Open a SEP-IRA through a bank or other financial institution. Set up the SEP plan for a year as late as the due date (including extensions) of your income tax. Traditional IRA. When you open a Traditional IRA account with Merrill, you may receive tax benefits and enjoy tax-deferred growth potential (contributions.

Godaddy Store Vs Shopify

In this comparison, we look at how features, pricing, and support differ so that you can answer the question: which ecommerce platform is best for you? From my experience, I think you could do your ecommerce with WordPress and WooCommerce in my opinion. Because it's free and you won't have any. I'm looking for a one-stop shop where I can have a website and company email. So far, I'm debating between GoDaddy and Shopify. Comparing Wix vs Shopify vs GoDaddy website builder it's clear that Wix has the highest overall score of , while Shopify was evaluated with overall rate. It depends on what you want to host on them. Comparing Shopify and GoDaddy is like comparing apples and oranges. Shopify is tailor-made for e-commerce websites. GoDaddy vs Shopify on Design In short, GoDaddy goes for ease of use & convenience with design features. Shopify goes for full customization options while. In this post I'm going to compare Shopify vs GoDaddy and help you decide between which one of these two popular ecommerce solutions is best for building your. GoDaddy has a very simple editor that lets you build a website quickly, but you get limited customization options and features. On the other hand, Shopify gives. Ease of Use GoDaddy's intuitive design allows swift store setup without intricate customization. Shopify counters with a user-friendly interface yet offers. In this comparison, we look at how features, pricing, and support differ so that you can answer the question: which ecommerce platform is best for you? From my experience, I think you could do your ecommerce with WordPress and WooCommerce in my opinion. Because it's free and you won't have any. I'm looking for a one-stop shop where I can have a website and company email. So far, I'm debating between GoDaddy and Shopify. Comparing Wix vs Shopify vs GoDaddy website builder it's clear that Wix has the highest overall score of , while Shopify was evaluated with overall rate. It depends on what you want to host on them. Comparing Shopify and GoDaddy is like comparing apples and oranges. Shopify is tailor-made for e-commerce websites. GoDaddy vs Shopify on Design In short, GoDaddy goes for ease of use & convenience with design features. Shopify goes for full customization options while. In this post I'm going to compare Shopify vs GoDaddy and help you decide between which one of these two popular ecommerce solutions is best for building your. GoDaddy has a very simple editor that lets you build a website quickly, but you get limited customization options and features. On the other hand, Shopify gives. Ease of Use GoDaddy's intuitive design allows swift store setup without intricate customization. Shopify counters with a user-friendly interface yet offers.

With its wide selection of themes, powerful theme editor, and extensive app store, Shopify offers users a higher level of customization flexibility. Whether you. In the GoDaddy vs Shopify debate, both platforms score well on the ease-of-use meter. Shopify's interface, although slightly technical, is intuitive and user-. GoDaddy charges a standard fee per transaction and subtracts from the amount you receive on your deposit. On the other hand, Shopify doesn't charge listing fees. Shopify is the winner. It supports over 14 different payment methods, including various digital wallets. Meanwhile, GoDaddy has fewer payment options. Reporting. To summarize the two, Shopify is best for users who want lots of inventory control, and are looking to build a complex online store. On the. In short, GoDaddy goes for ease of use & convenience with design features. Shopify goes for full customization options while maintaining some ease of use. Design your ecommerce website from s of templates · Email and social media marketing · One-time appointments · SSL certificate protects sensitive customer data. Customization is where Shopify shines. With a plethora of themes and an extensive app store, Shopify leads in adaptability and personalization. GoDaddy provides. Compare the top online store builders. Choose the best ecommerce website Shopify. GoDaddy. Commerce. $ /mo. with an annual term. Get Started. To put it simply, Shopify is the better option for users who need extensive inventory control and who want to create a sophisticated online business. GoDaddy. The difference is that Shopify offers 24/7 professional assistance and offers eCommerce discussion forum. You can easily explore what you require and interact. GoDaddy Website Builder has reviews and a rating of / 5 stars vs Shopify which has reviews and a rating of / 5 stars. Compare the. GoDaddy offers a more straightforward, cost-effective solution for integrating eCommerce into a general website, making it suitable for simpler online retail. Shopify ; Comparison of eCommerce Marketing features of Product A and Product B · GoDaddy. -. Ratings. Shopify. Ratings. 11% above category average. In terms of app availability, WooCommerce has under 1, extensions, while GoDaddy does not have an app store. In contrast, Shopify offers over 6, apps that. Shopify vs GoDaddy eCommerce website builder. In other words, GoDaddy prioritises usability and convenience in design elements. Shopify pursues completely. Compare Shopify vs GoDaddy Website Builder for Irish businesses. GetApp provides a side-by-side comparison with details on software price, features and. Features, Shopify, Godaddy ; First Year Cost, High, Lower ; Cost After First Year, Steady, High ; Domain Privacy, Free, Paid ; Domain Settings Setup, Easy, Easy. In the comparison between GoDaddy and Shopify for eCommerce success, both platforms offer unique advantages catering to different business needs. Comparison GoDaddy Online Store vs Shopify ; Website. irmanioradze.ru using GoDaddy Online Store ; Technology Description.